Page 276 - KFC Annual Report 2017

P. 276

IKHTISAR UTAMA LAPORAN MANAJEMEN PROFIL PERUSAHAAN ANALISA & PEMBAHASAN MANAJEMEN

Highlights Management Reports Company Profile Management’s Discussion & Analysis

The original financial statements included

herein are in Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2017 dan untuk As of December 31, 2017

Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended

(Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah,

Kecuali Dinyatakan Lain) Unless Otherwise Stated)

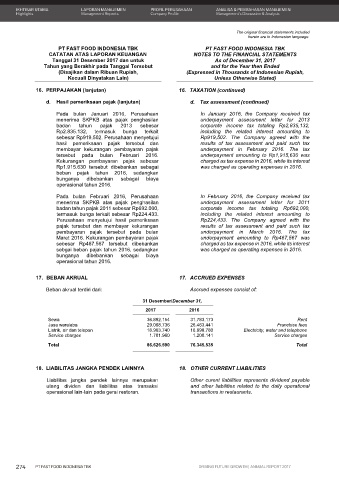

16. PERPAJAKAN (lanjutan) 16. TAXATION (continued)

d. Hasil pemeriksaan pajak (lanjutan) d. Tax assessment (continued)

Pada bulan Januari 2016, Perusahaan In January 2016, the Company received tax

menerima SKPKB atas pajak penghasilan underpayment assessment letter for 2013

badan tahun pajak 2013 sebesar corporate income tax totaling Rp2,835,132,

Rp2.835.132, termasuk bunga terkait including the related interest amounting to

sebesar Rp919.502. Perusahaan menyetujui Rp919,502. The Company agreed with the

hasil pemeriksaan pajak tersebut dan results of tax assessment and paid such tax

membayar kekurangan pembayaran pajak underpayment in February 2016. The tax

tersebut pada bulan Februari 2016. underpayment amounting to Rp1,915,630 was

Kekurangan pembayaran pajak sebesar charged as tax expense in 2016, while its interest

Rp1.915.630 tersebut dibebankan sebagai was charged as operating expenses in 2016.

beban pajak tahun 2016, sedangkan

bunganya dibebankan sebagai biaya

operasional tahun 2016.

Pada bulan Februari 2016, Perusahaan In February 2016, the Company received tax

menerima SKPKB atas pajak penghasilan underpayment assessment letter for 2011

badan tahun pajak 2011 sebesar Rp692.000, corporate income tax totaling Rp692,000,

termasuk bunga terkait sebesar Rp224.433. including the related interest amounting to

Perusahaan menyetujui hasil pemeriksaan Rp224,433. The Company agreed with the

pajak tersebut dan membayar kekurangan results of tax assessment and paid such tax

pembayaran pajak tersebut pada bulan underpayment in March 2016. The tax

Maret 2016. Kekurangan pembayaran pajak underpayment amounting to Rp467,567 was

sebesar Rp467.567 tersebut dibebankan charged as tax expense in 2016, while its interest

sebgai beban pajak tahun 2016, sedangkan was charged as operating expenses in 2016.

bunganya dibebankan sebagai biaya

operasional tahun 2016.

17. BEBAN AKRUAL 17. ACCRUED EXPENSES

Beban akrual terdiri dari: Accrued expenses consist of:

31 Desember/December 31,

2017 2016

Sewa 36.892.154 31.783.173 Rent

Jasa waralaba 29.068.736 26.463.441 Franchise fees

Listrik, air dan telepon 18.963.740 16.898.780 Electricity, water and telephone

Service charges 1.701.960 1.200.141 Service charges

Total 86.626.590 76.345.535 Total

18. LIABILITAS JANGKA PENDEK LAINNYA 18. OTHER CURRENT LIABILITIES

Liabilitas jangka pendek lainnya merupakan Other curent liabilities represents dividend payable

utang dividen dan liabilitas atas transaksi and other liabilities related to the daily operational

operasional lain-lain pada gerai restoran. transactions in restaurants.

51

274 PT FAST FOOD INDONESIA TBK DRIVING FUTURE GROWTH | ANNUAL REPORT 2017