Page 273 - KFC Annual Report 2017

P. 273

TATA KELOLA PERUSAHAAN TANGGUNG JAWAB SOSIAL PERUSAHAAN LAPORAN KEUANGAN

Corporate Governance Corporate Social Responsibility Financial Statement

The original financial statements included

herein are in Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2017 dan untuk As of December 31, 2017

Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended

(Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah,

Kecuali Dinyatakan Lain) Unless Otherwise Stated)

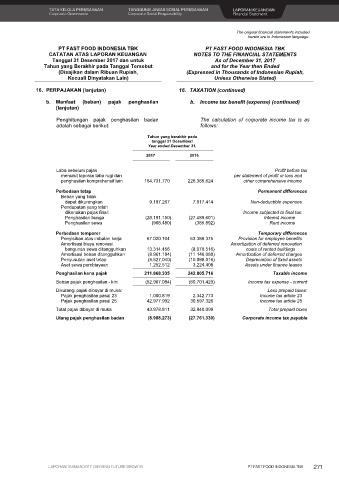

16. PERPAJAKAN (lanjutan) 16. TAXATION (continued)

b. Manfaat (beban) pajak penghasilan b. Income tax benefit (expense) (continued)

(lanjutan)

Penghitungan pajak penghasilan badan The calculation of corporate income tax is as

adalah sebagai berikut: follows:

Tahun yang berakhir pada

tanggal 31 Desember/

Year ended December 31,

2017 2016

Laba sebelum pajak Profit before tax

menurut laporan laba rugi dan per statement of profit or loss and

penghasilan komprehensif lain 164.731.770 226.365.624 other comprehensive income

Perbedaan tetap Permanent differences

Beban yang tidak

dapat dikurangkan 9.197.267 7.017.414 Non-deductible expenses

Pendapatan yang telah

dikenakan pajak final: Income subjected to final tax:

Penghasilan bunga (28.191.150) (27.489.601) Interest income

Penghasilan sewa (968.480) (385.892) Rent income

Perbedaan temporer Temporary differences

Penyisihan atas imbalan kerja 67.020.104 63.388.375 Provision for employee benefits

Amortisasi biaya renovasi Amortization of deferred renovation

bangunan sewa ditangguhkan 13.314.456 (8.070.516) costs of rented buildings

Amortisasi beban ditangguhkan (8.961.104) (11.146.080) Amortization of deferred charges

Penyusutan aset tetap (5.527.040) (10.098.016) Depreciation of fixed assets

Aset sewa pembiayaan 1.252.512 3.224.408 Assets under finance leases

Penghasilan kena pajak 211.868.335 242.805.716 Taxable income

Beban pajak penghasilan - kini (52.967.084) (60.701.429) Income tax expense - current

Dikurangi pajak dibayar di muka: Less prepaid taxes:

Pajak penghasilan pasal 23 1.000.819 2.342.773 Income tax article 23

Pajak penghasilan pasal 25 42.977.992 30.597.326 Income tax article 25

Total pajak dibayar di muka 43.978.811 32.940.099 Total prepaid taxes

Utang pajak penghasilan badan (8.988.273) (27.761.330) Corporate income tax payable

48

LAPORAN TAHUAN 2017 | DRIVING FUTURE GROWTH PT FAST FOOD INDONESIA TBK 271