Page 114 - Annual Report PT Fast Food Indonesia Tbk 2019

P. 114

EM

b

IKHTISAR KINERJA UTAMA lAPoRAN MANAJEMEN PRofIl PERUSAHAAN A ANAlISIS & PEMbAHASAN MANAJEMEN

& P

l

ISIS

NA

M

AHASAN

ANAJEMEN

M

N

NA

y

l

& A

PERfoRMANcE HIgHlIgHTS MANAgEMENT REPoRTS coMPANy PRofIlE MANAgEMENT’S DIScUSSIoN & ANAlySIS

ANA

c

IS

o

USSI

D

EMENT

g

S

’

SIS

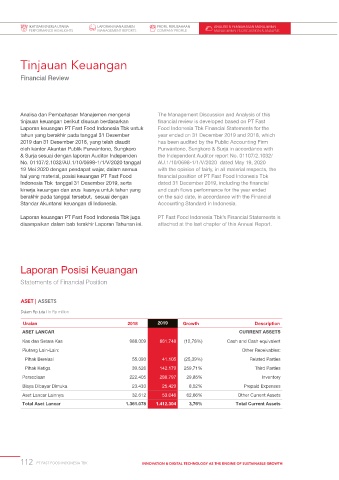

Tinjauan Keuangan

Financial Review

Analisa dan Pembahasan Manajemen mengenai The Management Discussion and Analysis of this

tinjauan keuangan berikut disusun berdasarkan financial review is developed based on PT Fast

Laporan keuangan PT Fast Food Indonesia Tbk untuk Food Indonesia Tbk Financial Statements for the

tahun yang berakhir pada tanggal 31 Desember year ended on 31 December 2019 and 2018, which

2019 dan 31 Desember 2018, yang telah diaudit has been audited by the Public Accounting Firm

oleh kantor Akuntan Publik Purwantono, Sungkoro Purwantono, Sungkoro & Surja in accordance with

& Surja sesuai dengan laporan Auditor Independen the Independent Auditor report No. 01107/2.1032/

No. 01107/2.1032/AU.1/10/0698-1/1/V/2020 tanggal AU.1/10/0698-1/1/V/2020 dated May 19, 2020

19 Mei 2020 dengan pendapat wajar, dalam semua with the opinion of fairly, in all material respects, the

hal yang material, posisi keuangan PT Fast Food financial position of PT Fast Food Indonesia Tbk

Indonesia Tbk tanggal 31 Desember 2019, serta dated 31 December 2019, including the financial

kinerja keuangan dan arus kasnya untuk tahun yang and cash flows performance for the year ended

berakhir pada tanggal tersebut, sesuai dengan on the said date, in accordance with the Financial

Standar Akuntansi keuangan di Indonesia. Accounting Standard in Indonesia.

Laporan keuangan PT Fast Food Indonesia Tbk juga PT Fast Food Indonesia Tbk’s Financial Statements is

disampaikan dalam bab terakhir Laporan Tahunan ini. attached at the last chapter of this Annual Report.

Laporan Posisi Keuangan

Statements of Financial Position

ASET | ASSETS

Dalam Rp juta | In Rp million

Uraian 2018 2019 Growth Description

aseT LanCar CUrrenT asseTs

Kas dan Setara Kas 988.009 861.748 (12,78%) Cash and Cash equivalent

Piutang Lain-Lain: Other Receivables:

Pihak Berelasi 55.093 41.105 (25,39%) Related Parties

Pihak Ketiga 39.526 142.179 259,71% Third Parties

Persediaan 222.405 288.797 29,85% Inventory

Biaya Dibayar Dimuka 23.433 25.429 8,52% Prepaid Expenses

Aset Lancar Lainnya 32.612 53.046 62,66% Other Current Assets

Total aset Lancar 1.361.078 1.412.304 3,76% Total Current assets

112 PT FAST FOOD INDONESIA TBK INNOVATION & DIGITAL TECHNOLOGY AS THE ENGINE OF SUSTAINABLE GROWTH