Page 381 - Annual Report PT Fast Food Indonesia Tbk 2024

P. 381

The original financial statements included herein are in the Indonesian

language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN NOTES TO THE CONSOLIDATED

KEUANGAN KONSOLIDASIAN FINANCIAL STATEMENTS

Tanggal 31 Desember 2024 dan untuk As of December 31, 2024 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

19. UANG MUKA DARI PEMEGANG SAHAM 19. ADVANCE PAYMENT FROM SHAREHOLDER

Pada Desember 2024, Perusahaan menerima uang In December 2024, the Company received an

muka dari salah satu pemegang saham, PT Gelael advance payment from one of its shareholders, PT

Pratama, terkait dengan perjanjian Gelael Pratama, related to a conditional share

pengambilbagian saham bersyarat dengan tujuan subscription agreement with the aim of supporting the

untuk mendukung kegiatan operasional Company's operational activities, amounting to

Perusahaan, sebesar Rp40.000.000. Perjanjian Rp40,000,000. The agreement will be terminated if

akan berakhir apabila persyaratan tidak terpenuhi the requirements are not met, and the Company will

dan Perusahaan wajib mengembalikan uang muka be required to return the advance payment received.

yang sudah diterima.

20. ASET HAK-GUNA DAN LIABILITAS SEWA 20. RIGHT-OF-USE ASSETS AND LEASE LIABILITIES

Perusahaan memiliki kontrak sewa yang sebagian The Company has lease contracts mostly for stores

besar untuk gerai dan gudang yang digunakan and warehouses in its operational activities, which

dalam kegiatan operasionalnya, yang memiliki have various lease terms up to 10 years.

masa sewa beragam hingga 10 tahun.

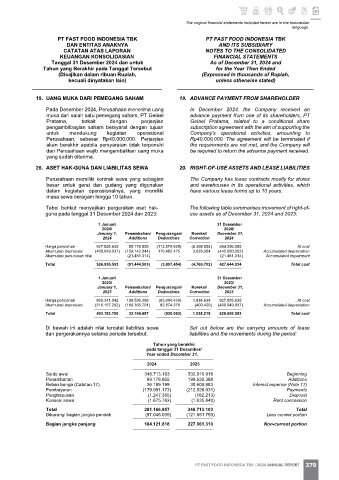

Tabel berikut menyajikan pergerakan aset hak- The following table summarises movement of right-of-

guna pada tanggal 31 Desember 2024 dan 2023: use assets as of December 31, 2024 and 2023:

1 Januari 31 Desember

2024/ 2024/

January 1, Penambahan/ Pengurangan/ Koreksi/ December 31,

2024 Additions Deductions Correction 2024

Harga perolehan 927.005.630 89.178.855 (113.579.929) (8.398.006 ) 894.206.550 At cost

Akumulasi depresiasi (400.049.037) (159.142.044) 110.482.475 3.628.304 (445.080.302) Accumulated depreciation

Akumulasi penurunan nilai - (21.481.314) - - (21.481.314) Accumulated impairment

Total 526.956.593 (91.444.503) (3.097.454) (4.769.702 ) 427.644.934 Total cost

1 Januari 31 Desember

2023/ 2023/

January 1, Penambahan/ Pengurangan/ Koreksi/ December 31,

2023 Additions Deductions Correction 2023

Harga perolehan 809.341.042 199.530.388 (83.804.439) 1.938.639 927.005.630 At cost

Akumulasi depresiasi (316.157.292) (166.365.701) 82.874.376 (400.420 ) (400.049.037) Accumulated depreciation

Total 493.183.750 33.164.687 (930.063) 1.538.219 526.956.593 Total cost

Di bawah ini adalah nilai tercatat liabilitas sewa Set out below are the carrying amounts of lease

dan pergerakannya selama periode tersebut: liabilities and the movements during the period:

Tahun yang berakhir

pada tanggal 31 Desember/

Year ended December 31,

2024 2023

Saldo awal 348.713.103 332.916.916 Beginning

Penambahan 89.178.855 199.530.388 Additions

Beban bunga (Catatan 17) 26.189.199 30.609.883 Interest expense (Note 17)

Pembayaran (179.991.173) (212.526.031) Payments

Penghapusan (1.247.365) (182.213) Disposal

Konsesi sewa (1.675.762) (1.635.840) Rent concession

Total 281.166.857 348.713.103 Total

Dikurangi bagian jangka pendek (97.045.039) (121.651.793) Less current portion

Bagian jangka panjang 184.121.818 227.061.310 Non-current portion

70

PT FAST FOOD INDONESIA TBK | 2024 ANNUAL REPORT 379