Page 264 - KFC Annual Report 2017

P. 264

IKHTISAR UTAMA LAPORAN MANAJEMEN PROFIL PERUSAHAAN ANALISA & PEMBAHASAN MANAJEMEN

Highlights Management Reports Company Profile Management’s Discussion & Analysis

The original financial statements included

herein are in Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2017 dan untuk As of December 31, 2017

Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended

(Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah,

Kecuali Dinyatakan Lain) Unless Otherwise Stated)

5. PIUTANG LAIN-LAIN 5. OTHER RECEIVABLES

Piutang lain-lain pihak ketiga terutama merupakan Other receivables mainly represent receivables from

tagihan kepada pengelola food court atas hasil food court management for the sales of foods and

penjualan makanan dan minuman dan insentif beverages and incentives from suppliers. All other

dari pemasok. Seluruh piutang lain-lain adalah receivables are dominated in Rupiah.

dalam mata uang Rupiah.

Piutang lain-lain dari pihak berelasi dijelaskan Other receivables due from related parties are

dalam Catatan 29. disclosed in Note 29.

Berdasarkan hasil penelaahan terhadap adanya Based on the results of review for impairment of other

penurunan nilai piutang lain-lain pada akhir tahun, receivables at the end of the year, the Company’s

manajemen Perusahaan berkeyakinan bahwa management believes that the entire receivables are

seluruh piutang dapat tertagih sehingga tidak ada collectible and, hence, no impairment losses on

kerugian penurunan nilai atas piutang yang harus receivables should be recorded.

dicatat.

Piutang lain-lain tidak dijaminkan, tidak dibebani Other receivables are unsecured, non-interest

bunga dan penyelesaiannya akan dilakukan bearing and will be settled in cash.

secara tunai.

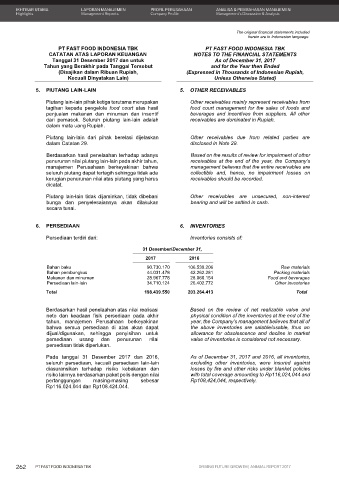

6. PERSEDIAAN 6. INVENTORIES

Persediaan terdiri dari: Inventories consists of:

31 Desember/December 31,

2017 2016

Bahan baku 90.730.170 106.539.206 Raw materials

Bahan pembungkus 44.031.478 42.262.281 Packing materials

Makanan dan minuman 28.967.778 28.060.154 Food and beverages

Persediaan lain-lain 34.710.124 26.402.772 Other inventories

Total 198.439.550 203.264.413 Total

Berdasarkan hasil penelaahan atas nilai realisasi Based on the review of net realizable value and

neto dan keadaan fisik persediaan pada akhir physical condition of the inventories at the end of the

tahun, manajemen Perusahaan berkeyakinan year, the Company’s management believes that all of

bahwa semua persediaan di atas akan dapat the above inventories are salable/usable, thus an

dijual/digunakan, sehingga penyisihan untuk allowance for obsolescence and decline in market

persediaan usang dan penurunan nilai value of inventories is considered not necessary.

persediaan tidak diperlukan.

Pada tanggal 31 Desember 2017 dan 2016, As of December 31, 2017 and 2016, all inventories,

seluruh persediaan, kecuali persediaan lain-lain excluding other inventories, were insured against

diasuransikan terhadap risiko kebakaran dan losses by fire and other risks under blanket policies

risiko lainnya berdasarkan paket polis dengan nilai with total coverage amounting to Rp116,024,044 and

pertanggungan masing-masing sebesar Rp108,424,044, respectively.

Rp116.024.044 dan Rp108.424.044.

39

262 PT FAST FOOD INDONESIA TBK DRIVING FUTURE GROWTH | ANNUAL REPORT 2017