Page 262 - KFC Annual Report 2017

P. 262

IKHTISAR UTAMA LAPORAN MANAJEMEN PROFIL PERUSAHAAN ANALISA & PEMBAHASAN MANAJEMEN

Highlights Management Reports Company Profile Management’s Discussion & Analysis

The original financial statements included

herein are in Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2017 dan untuk As of December 31, 2017

Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended

(Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah,

Kecuali Dinyatakan Lain) Unless Otherwise Stated)

3. PERTIMBANGAN, ESTIMASI DAN ASUMSI 3. SIGNIFICANT JUDGMENTS, ESTIMATES AND

SIGNIFIKAN (lanjutan) ASSUMPTIONS (continued)

ii. Estimasi dan asumsi (lanjutan) ii. Estimates and assumptions (continued)

Aset pajak tangguhan Deferred tax assets

Aset pajak tangguhan diakui atas seluruh Deferred tax assets are recognized for all

perbedaan temporer yang dapat dikurangkan deductible temporary differences and unused tax

dan rugi fiskal yang belum digunakan losses to the extent that it is probable that taxable

sepanjang besar kemungkinannya bahwa profit will be available against which the losses

penghasilan kena pajak akan tersedia can be utilized. Significant management

sehingga perbedaan temporer yang dapat estimates are required to determine the amount

dikurangkan dan rugi fiskal tersebut dapat of deferred tax assets that can be recognized,

digunakan. Estimasi signifikan oleh based upon the likely timing and the level of future

manajemen disyaratkan dalam menentukan taxable profits together with future tax planning

jumlah aset pajak tangguhan yang dapat strategies. Further details are disclosed in

diakui, berdasarkan saat penggunaan dan Note 16.

tingkat penghasilan kena pajak dan strategi

perencanaan pajak masa depan. Penjelasan

lebih rinci diungkapkan dalam Catatan 16.

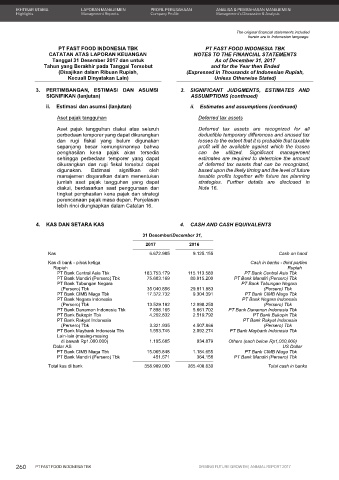

4. KAS DAN SETARA KAS 4. CASH AND CASH EQUIVALENTS

31 Desember/December 31,

2017 2016

Kas 6.672.985 9.125.155 Cash on hand

Kas di bank - pihak ketiga Cash in banks - third parties

Rupiah Rupiah

PT Bank Central Asia Tbk 183.753.179 115.113.580 PT Bank Central Asia Tbk

PT Bank Mandiri (Persero) Tbk 75.603.169 80.915.200 PT Bank Mandiri (Persero) Tbk

PT Bank Tabungan Negara PT Bank Tabungan Negara

(Persero) Tbk 35.040.856 29.811.883 (Persero) Tbk

PT Bank CIMB Niaga Tbk 17.372.732 9.304.391 PT Bank CIMB Niaga Tbk

PT Bank Negara Indonesia PT Bank Negara Indonesia

(Persero) Tbk 13.529.182 12.998.250 (Persero) Tbk

PT Bank Danamon Indonesia Tbk 7.898.165 5.661.702 PT Bank Danamon Indonesia Tbk

PT Bank Bukopin Tbk 4.202.832 2.519.792 PT Bank Bukopin Tbk

PT Bank Rakyat Indonesia PT Bank Rakyat Indonesia

(Persero) Tbk 3.321.935 4.507.866 (Persero) Tbk

PT Bank Maybank Indonesia Tbk 1.553.746 2.092.274 PT Bank Maybank Indonesia Tbk

Lain-lain (masing-masing

di bawah Rp1.000.000) 1.195.685 934.879 Others (each below Rp1,000,000)

Dolar AS US Dollar

PT Bank CIMB Niaga Tbk 15.065.848 1.184.655 PT Bank CIMB Niaga Tbk

PT Bank Mandiri (Persero) Tbk 451.671 364.158 PT Bank Mandiri (Persero) Tbk

Total kas di bank 358.989.000 265.408.630 Total cash in banks

37

260 PT FAST FOOD INDONESIA TBK DRIVING FUTURE GROWTH | ANNUAL REPORT 2017