Page 399 - Annual Report PT Fast Food Indonesia Tbk 2024

P. 399

The original financial statements included herein are in the Indonesian

language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN NOTES TO THE CONSOLIDATED

KEUANGAN KONSOLIDASIAN FINANCIAL STATEMENTS

Tanggal 31 Desember 2024 dan untuk As of December 31, 2024 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

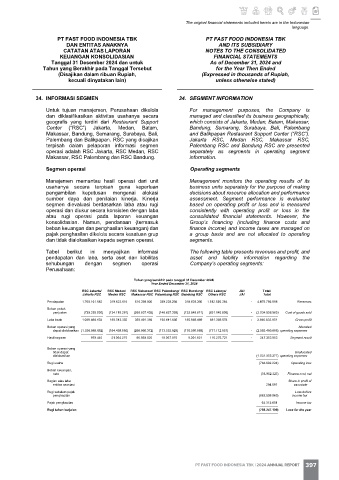

34. INFORMASI SEGMEN 34. SEGMENT INFORMATION

Untuk tujuan manajemen, Perusahaan dikelola For management purposes, the Company is

dan diklasifikasikan aktivitas usahanya secara managed and classified its business geographically,

geografis yang terdiri dari Restaurant Support which consists of Jakarta, Medan, Batam, Makassar,

Center (“RSC”) Jakarta, Medan, Batam, Bandung, Semarang, Surabaya, Bali, Palembang

Makassar, Bandung, Semarang, Surabaya, Bali, and Balikpapan Restaurant Support Center (“RSC”).

Palembang dan Balikpapan. RSC yang disajikan Jakarta RSC, Medan RSC, Makassar RSC,

terpisah dalam pelaporan informasi segmen Palembang RSC and Bandung RSC are presented

operasi adalah RSC Jakarta, RSC Medan, RSC separately as segments in operating segment

Makassar, RSC Palembang dan RSC Bandung. information.

Segmen operasi Operating segments

Manajemen memantau hasil operasi dari unit Management monitors the operating results of its

usahanya secara terpisah guna keperluan business units separately for the purpose of making

pengambilan keputusan mengenai alokasi decisions about resource allocation and performance

sumber daya dan penilaian kinerja. Kinerja assessment. Segment performance is evaluated

segmen dievaluasi berdasarkan laba atau rugi based on operating profit or loss and is measured

operasi dan diukur secara konsisten dengan laba consistently with operating profit or loss in the

atau rugi operasi pada laporan keuangan consolidated financial statements. However, the

konsolidasian. Namun, pendanaan (termasuk Group’s financing (including finance costs and

beban keuangan dan penghasilan keuangan) dan finance income) and income taxes are managed on

pajak penghasilan dikelola secara kesatuan grup a group basis and are not allocated to operating

dan tidak dialokasikan kepada segmen operasi. segments.

Tabel berikut ini menyajikan informasi The following table presents revenues and profit, and

pendapatan dan laba, serta aset dan liabilitas asset and liability information regarding the

sehubungan dengan segmen operasi Company’s operating segments:

Perusahaan:

Tahun yang berakhir pada tanggal 31 Desember 2024/

Year Ended December 31, 2024

RSC Jakarta/ RSC Medan/ RSC Makassar/ RSC Palembang/ RSC Bandung/ RSC Lainnya/ JAI/ Total/

Jakarta RSC Medan RSC Makassar RSC Palembang RSC Bandung RSC Others RSC JAI Total

Pendapatan 1.769.161.182 319.623.616 616.398.830 339.239.204 318.839.300 1.512.530.384 - 4.875.792.516 Revenues

Beban pokok

penjualan (729.293.050) (134.110.261) (260.937.438) (146.627.399) (132.849.611) (631.140.806) - (2.034.958.565) Cost of goods sold

Laba bruto 1.039.868.132 185.513.355 355.461.392 192.611.805 185.989.689 881.389.578 - 2.840.833.951 Gross profit

Beban operasi yang Allocated

dapat dialokasikan (1.038.888.692) (164.459.080) (268.868.372) (173.553.829) (176.598.068) (771.112.857) - (2.593.480.898) operating expenses

Hasil segmen 979.440 21.054.275 86.593.020 19.057.976 9.391.621 110.276.721 - 247.353.053 Segment result

Beban operasi yang

tidak dapat Unallocated

dialokasikan (1.031.355.277) operating expenses

Rugi usaha (784.002.224) Operating loss

Beban keuangan,

neto (78.852.327) Finance cost, net

Bagian atas laba Share in profit of

entitas asosiasi 294.591 associate

Rugi sebelum pajak Loss before

penghasilan (862.559.960) income tax

Pajak penghasilan 64.312.851 Income tax

Rugi tahun berjalan (798.247.109) Loss for the year

88

PT FAST FOOD INDONESIA TBK | 2024 ANNUAL REPORT 397