Page 397 - Annual Report PT Fast Food Indonesia Tbk 2024

P. 397

The original financial statements included herein are in the Indonesian

language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN NOTES TO THE CONSOLIDATED

KEUANGAN KONSOLIDASIAN FINANCIAL STATEMENTS

Tanggal 31 Desember 2024 dan untuk As of December 31, 2024 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

32. TUJUAN DAN KEBIJAKAN MANAJEMEN 32. FINANCIAL RISK MANAGEMENT OBJECTIVES

RISIKO KEUANGAN (lanjutan) AND POLICIES (continued)

Risiko Likuiditas Liquidity Risk

Grup mengelola profil likuiditasnya untuk The Group manages its liquidity profile to be able

membiayai kegiatan operasional dan melunasi to finance its operational activities and settle its

utang yang jatuh tempo dengan menyediakan kas maturing debts by maintaining sufficient cash and

dan setara kas yang cukup, dan ketersediaan cash equivalents, and the availability of funding

pendanaan melalui kecukupan jumlah fasilitas through an adequate amount of committed credit

kredit yang diterima. facilities.

Grup secara teratur mengevaluasi informasi arus The Group regularly evaluates its projected and

kas proyeksi dan aktual dan terus-menerus actual cash flow information and continuously

memantau kondisi pasar keuangan untuk assesses conditions in the financial markets for

mengidentifikasikan kesempatan melakukan opportunities to pursue fund-raising initiative,

penggalangan dana yang mencakup utang bank including bank loans and equity market.

dan pasar modal.

Tabel di bawah ini merupakan jadwal jatuh tempo The table below summarizes the maturity profile of

liabilitas keuangan Grup pada tanggal the Group’s financial liabilities as of

31 Desember 2024 dan 2023, berdasarkan arus December 31, 2024 and 2023, based on

kas kontraktual yang tidak terdiskonto, yang undiscounted contractual payments, which include

mencakup beban bunga terkait: the related interest charges:

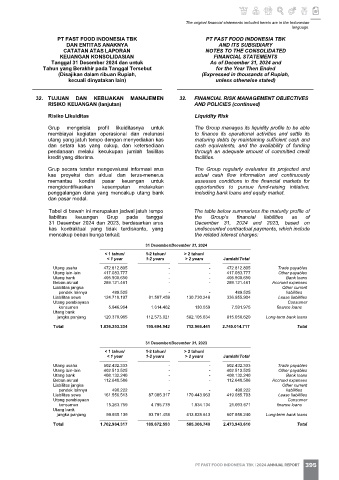

31 Desember/December 31, 2024

< 1 tahun/ 1-2 tahun/ > 2 tahun/

< 1 year 1-2 years > 2 years Jumlah/Total

Utang usaha 472.812.805 - - 472.812.805 Trade payables

Utang lain-lain 417.083.777 - - 417.083.777 Other payables

Utang bank 405.900.650 - - 405.900.650 Bank loans

Beban akrual 289.121.461 - - 289.121.461 Accrued expenses

Liabilitas jangka Other current

pendek lainnya 489.525 - - 489.525 liabilities

Liabilitas sewa 124.718.197 81.507.459 130.730.248 336.955.904 Lease liabilities

Utang pembiayaan Consumer

konsumen 5.846.954 1.614.462 130.559 7.591.975 finance loans

Utang bank

jangka panjang 120.379.965 112.573.021 582.105.634 815.058.620 Long-term bank loans

Total 1.836.353.334 195.694.942 712.966.441 2.745.014.717 Total

31 Desember/December 31, 2023

< 1 tahun/ 1-2 tahun/ > 2 tahun/

< 1 year 1-2 years > 2 years Jumlah/Total

Utang usaha 502.432.333 - - 502.432.333 Trade payables

Utang lain-lain 402.513.525 - - 402.513.525 Other payables

Utang bank 408.132.240 - - 408.132.240 Bank loans

Beban akrual 112.640.586 - - 112.640.586 Accrued expenses

Liabilitas jangka Other current

pendek lainnya 490.222 - - 490.222 liabilities

Liabilitas sewa 161.556.513 87.085.317 170.443.963 419.085.793 Lease liabilities

Utang pembiayaan Consumer

konsumen 15.263.759 4.795.778 1.034.134 21.093.671 finance loans

Utang bank

jangka panjang 99.935.139 93.791.458 413.828.643 607.555.240 Long-term bank loans

Total 1.702.964.317 185.672.553 585.306.740 2.473.943.610 Total

86

PT FAST FOOD INDONESIA TBK | 2024 ANNUAL REPORT 395