Page 375 - Annual Report PT Fast Food Indonesia Tbk 2024

P. 375

The original financial statements included herein are in the Indonesian

language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN NOTES TO THE CONSOLIDATED

KEUANGAN KONSOLIDASIAN FINANCIAL STATEMENTS

Tanggal 31 Desember 2024 dan untuk As of December 31, 2024 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

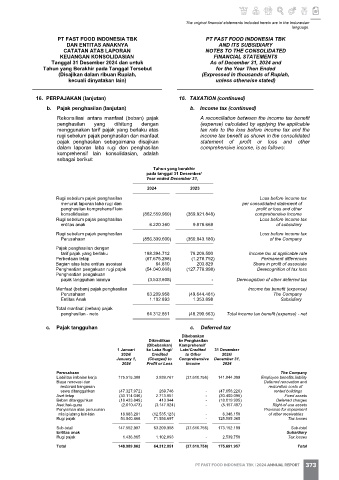

16. PERPAJAKAN (lanjutan) 16. TAXATION (continued)

b. Pajak penghasilan (lanjutan) b. Income tax (continued)

Rekonsiliasi antara manfaat (beban) pajak A reconciliation between the income tax benefit

penghasilan yang dihitung dengan (expense) calculated by applying the applicable

menggunakan tarif pajak yang berlaku atas tax rate to the loss before income tax and the

rugi sebelum pajak penghasilan dan manfaat income tax benefit as shown in the consolidated

pajak penghasilan sebagaimana disajikan statement of profit or loss and other

dalam laporan laba rugi dan penghasilan comprehensive income, is as follows:

komprehensif lain konsolidasian, adalah

sebagai berikut:

Tahun yang berakhir

pada tanggal 31 Desember/

Year ended December 31,

2024 2023

Rugi sebelum pajak penghasilan Loss before income tax

menurut laporan laba rugi dan per consolidated statement of

penghasilan komprehensif lain profit or loss and other

konsolidasian (862.559.960) (369.921.848) comprehensive income

Rugi sebelum pajak penghasilan Loss before income tax

entitas anak 6.220.360 9.878.668 of subsidiary

Rugi sebelum pajak penghasilan Loss before income tax

Perusahaan (856.339.600) (360.043.180) of the Company

Pajak penghasilan dengan

tarif pajak yang berlaku 188.394.712 79.209.500 Income tax at applicable rate

Perbedaan tetap (67.675.288) (1.278.792) Permanent differences

Bagian atas laba entitas asosiasi 64.810 203.829 Share in profit of associate

Penghentian pengakuan rugi pajak (54.040.668) (127.778.998) Derecognition of tax loss

Penghentian pengakuan

pajak tangguhan lainnya (3.533.608) - Derecognition of other deferred tax

Manfaat (beban) pajak penghasilan Income tax benefit (expense)

Perusahaan 63.209.958 (49.644.461) The Company

Entitas Anak 1.102.893 1.353.898 Subsidiary

Total manfaat (beban) pajak

penghasilan - neto 64.312.851 (48.290.563) Total income tax benefit (expense) - net

c. Pajak tangguhan c. Deferred tax

Dibebankan

Dikreditkan ke Penghasilan

(Dibebankan) Komprehensif

1 Januari ke Laba Rugi/ Lain/Credited 31 Desember

2024/ Credited to Other 2024/

January 1, (Charged) to Comprehensive December 31,

2024 Profit or Loss Income 2024

Perusahaan The Company

Liabilitas imbalan kerja 175.515.388 3.939.767 (37.610.756) 141.844.399 Employee benefits liability

Biaya renovasi dan Deferred renovation and

restorasi bangunan restoration costs of

sewa ditangguhkan (47.327.972) 269.746 - (47.058.226) rented buildings

Aset tetap (33.114.046) 2.713.951 - (30.400.095) Fixed assets

Beban ditangguhkan (18.433.849) 413.944 - (18.019.905) Deferred charges

Aset hak-guna (2.010.473) (3.147.024) - (5.157.497) Right-of-use assets

Penyisihan atas penurunan Provision for impairment

nilai piutang lain-lain 18.883.281 (12.535.123) - 6.348.158 of other receivables

Rugi pajak 54.040.668 71.554.697 - 125.595.365 Tax losses

Sub-total 147.552.997 63.209.958 (37.610.756) 173.152.199 Sub-total

Entitas anak Subsidiary

Rugi pajak 1.436.865 1.102.893 - 2.539.758 Tax losses

Total 148.989.862 64.312.851 (37.610.756) 175.691.957 Total

64

PT FAST FOOD INDONESIA TBK | 2024 ANNUAL REPORT 373