Page 361 - AR SR FFI 2023_0805_Low

P. 361

The original financial statements included The original financial statements included

herein are in the Indonesian language. herein are in the Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued) KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued)

Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah, (Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated) kecuali dinyatakan lain) unless otherwise stated)

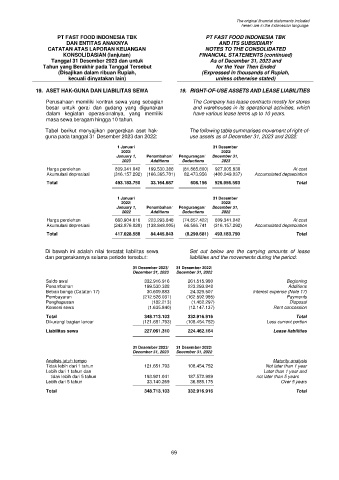

17. UTANG BANK (lanjutan) 17. BANK LOANS (continued) 19. ASET HAK-GUNA DAN LIABILITAS SEWA 19. RIGHT-OF-USE ASSETS AND LEASE LIABILITIES

Pada tanggal 31 Desember 2023, Perusahaan tidak As of December 31, 2023, the Company did not Perusahaan memiliki kontrak sewa yang sebagian The Company has lease contracts mostly for stores

memenuhi rasio keuangan untuk pinjaman kepada meet with financial ratios for BNI loans as stipulated besar untuk gerai dan gudang yang digunakan and warehouses in its operational activities, which

BNI seperti yang ditetapkan dalam perjanjian kredit in the respective loan agreements and had not dalam kegiatan operasionalnya, yang memiliki have various lease terms up to 10 years.

dan belum memperoleh surat waiver sesuai obtained the waivers letter as required by respective masa sewa beragam hingga 10 tahun.

ketentuan perjanjian kredit terkait, sehingga seluruh loan agreement, resulting in all of the principal

jumlah pokok yang dipinjam dari BNI diklasifikasikan amount borrowed from BNI reclassified as current Tabel berikut menyajikan pergerakan aset hak- The following table summarises movement of right-of-

menjadi liabilitas jangka pendek untuk tujuan liabilities for consolidated financial statements guna pada tanggal 31 Desember 2023 dan 2022: use assets as of December 31, 2023 and 2022:

penyajian laporan keuangan konsolidasian. Selain presentation purposes. Apart from Company’s

1 Januari 31 Desember

pinjaman Perusahaan kepada BNI, Perusahaan dan loans to BNI, the Company and its subsidiary have

2023/ 2023/

entitas anak telah memenuhi semua persyaratan fulfilled all loan requirements required by respective January 1, Penambahan/ Pengurangan/ December 31,

pinjaman terkait. loan agreement. 2023 Additions Deductions 2023

Harga perolehan 809.341.042 199.530.388 (81.865.800) 927.005.630 At cost

Pada tanggal 31 Desember 2022, Perusahaan telah As of December 31, 2022, the Company complied Akumulasi depresiasi (316.157.292) (166.365.701) 82.473.956 (400.049.037) Accumulated depreciation

memenuhi semua persyaratan pinjaman tersebut di with all of the covenants of the above-mentioned

atas seperti disebutkan dalam perjanjian kredit loans as stipulated in the respective loan Total 493.183.750 33.164.687 608.156 526.956.593 Total

terkait atau memperoleh surat waiver sesuai agreements or obtained waiver letter as required by

ketentuan perjanjian kredit terkait. respective loan agreement. 1 Januari 31 Desember

2022/ 2022/

Beban bunga atas utang bank disajikan sebagai Interest expense of bank loans is presented as part January 1, Penambahan/ Pengurangan/ December 31,

2022 Additions Deductions 2022

bagian dari akun “Beban keuangan” pada laporan of “Finance costs” account in the consolidated

laba rugi dan penghasilan komprehensif lain statement of profit or loss and other comprehensive Harga perolehan 660.904.616 223.293.848 (74.857.422) 809.341.042 At cost

konsolidasian. income. Akumulasi depresiasi (243.876.028) (138.848.005) 66.566.741 (316.157.292) Accumulated depreciation

Total 417.028.588 84.445.843 (8.290.681) 493.183.750 Total

Beban keuangan terdiri dari: Finance costs consist of:

31 Desember 2023/ 31 Desember 2022/ Di bawah ini adalah nilai tercatat liabilitas sewa Set out below are the carrying amounts of lease

December 31, 2023 December 31, 2022

dan pergerakannya selama periode tersebut: liabilities and the movements during the period:

Utang bank 41.790.975 33.487.298 Bank loans

Sewa (Catatan 19) 30.609.883 24.329.507 Rent (Note 19) 31 Desember 2023/ 31 Desember 2022/

Lain-lain 1.647.038 1.337.600 Others December 31, 2023 December 31, 2022

Total 74.047.896 59.154.405 Total Saldo awal 332.916.916 261.515.980 Beginning

Penambahan 199.530.388 223.293.848 Additions

Beban bunga (Catatan 17) 30.609.883 24.329.507 Interest expense (Note 17)

Pembayaran (212.526.031) (162.592.985) Payments

18. BEBAN AKRUAL 18. ACCRUED EXPENSES

Penghapusan (182.213) (1.482.297) Disposal

Konsesi sewa (1.635.840) (12.147.137) Rent concession

Beban akrual terdiri dari: Accrued expenses consist of:

Total 348.713.103 332.916.916 Total

31 Desember 2023/ 31 Desember 2022/ Dikurangi bagian lancar (121.651.793) (108.454.752) Less current portion

December 31, 2023 December 31, 2022

Liabilitas sewa 227.061.310 224.462.164 Lease liabilities

Sewa 52.884.009 57.162.555 Rent

Listrik, air dan telepon 28.306.091 24.275.710 Electricity, water and telephone

Jasa waralaba 25.679.751 97.001.129 Franchise fees

31 Desember 2023/ 31 Desember 2022/

Service charges 4.378.876 3.380.525 Service charges December 31, 2023 December 31, 2022

Lain-lain 1.391.859 908.484 Others

Analisis jatuh tempo Maturity analysis

Total 112.640.586 182.728.403 Total Tidak lebih dari 1 tahun 121.651.793 108.454.752 Not later than 1 year

Lebih dari 1 tahun dan Later than 1 year and

tidak lebih dari 5 tahun 193.921.041 187.572.989 not later than 5 years

Jasa waralaba merupakan kompensasi yang wajib Franchise fee is a compensation that the Company Lebih dari 5 tahun 33.140.269 36.889.175 Over 5 years

dibayarkan oleh Perusahaan ke franchisor sebesar obliged to pay to franchisor by 6% of revenue

Total 348.713.103 332.916.916 Total

6% dari pendapatan (Catatan 36). (Note 36).

68 69