Page 353 - AR SR FFI 2023_0805_Low

P. 353

The original financial statements included The original financial statements included

herein are in the Indonesian language. herein are in the Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued) KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued)

Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah, (Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated) kecuali dinyatakan lain) unless otherwise stated)

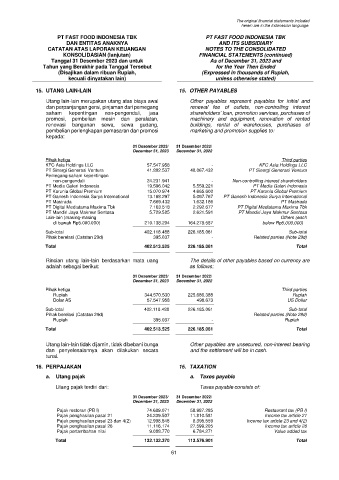

13. ASET TIDAK LANCAR LAINNYA (lanjutan) 13. OTHER NON-CURRENT ASSETS (continued) 15. UTANG LAIN-LAIN 15. OTHER PAYABLES

Piutang pemegang saham non-pengendali atas Non-controlling shareholder receivables in Utang lain-lain merupakan utang atas biaya awal Other payables represent payables for initial and

Entitas Anak merupakan piutang atas nama Subsidiary represents receivables in the names of dan perpanjangan gerai, pinjaman dari pemegang renewal fee of outlets, non-controlling interest

Bapak Djajeng Pristiwan dan Bapak Erwin FX Mr. Djajeng Pristiwan and Mr. Erwin FX Bengie, each saham kepentingan non-pengendali, jasa shareholders’ loan, promotion services, purchases of

Bengie sebesar Rp15.000.000 yang tidak memiliki totaling to Rp15,000,000, which do not have a promosi, pembelian mesin dan peralatan, machinery and equipment, renovation of rented

jangka waktu pengembalian dan tanpa bunga. repayment period and no interest. renovasi bangunan sewa, sewa gudang, buildings, rental of warehouses, purchases of

pembelian perlengkapan pemasaran dan promosi marketing and promotion supplies to:

Aset yang ditangguhkan penggunaannya The asset that temporary suspended is restaurant kepada:

merupakan gerai restoran yang tidak lagi outlet that is no longer operating but is in the process

beroperasi namun dalam proses renovasi untuk of being renovated to be rented out to third parties. 31 Desember 2023/ 31 Desember 2022/

nantinya disewakan kepada pihak ketiga. December 31, 2023 December 31, 2022

14. UTANG USAHA 14. TRADE PAYABLES Pihak ketiga Third parties

KFC Asia Holdings LLC 57.547.958 - KFC Asia Holdings LLC

Utang usaha terdiri dari utang kepada para Trade payables consist of payables to the following PT Sinergi Generasi Ventura 41.802.537 40.067.432 PT Sinergi Generasi Ventura

pemasok di bawah ini yang timbul dari pembelian suppliers arising from purchases of raw materials. All Pemegang saham kepentingan

bahan baku. Seluruh utang usaha dalam mata trade payables are denominated in Rupiah. non-pengendali 24.231.941 5.559.221 - Non-controlling interest shareholders

PT Media Galeri Indonesia

19.596.042

PT Media Galeri Indonesia

uang Rupiah.

PT Karunia Global Premium 15.070.974 4.665.600 PT Karunia Global Premium

PT Ganesh Indonesia Surya International 13.168.297 5.067.767 PT Ganesh Indonesia Surya International

Rincian utang usaha adalah sebagai berikut: The details of trade payables are as follows:

PT Mastrada 7.669.432 1.632.186 PT Mastrada

31 Desember 2023/ 31 Desember 2022/ PT Digital Mediatama Maxima Tbk 7.163.518 2.292.677 PT Digital Mediatama Maxima Tbk

December 31, 2023 December 31, 2022 PT Mandiri Jaya Makmur Sentosa 5.729.585 2.621.591 PT Mandiri Jaya Makmur Sentosa

Lain-lain (masing-masing Others (each

Pihak ketiga Third parties di bawah Rp5.000.000) 210.138.204 164.278.587 below Rp5,000,000)

PT Sukanda Djaya 39.811.086 35.817.897 PT Sukanda Djaya

PT Karya Pangan Sejahtera 39.702.683 27.966.476 PT Karya Pangan Sejahtera Sub-total 402.118.488 226.185.061 Sub-total

PT Kulinari Boga Semesta 38.363.552 17.079.649 PT Kulinari Boga Semesta Pihak berelasi (Catatan 29d) 395.037 - Related parties (Note 29d)

PT Charoen Pokphand Indonesia Tbk 26.459.664 26.531.546 PT Charoen Pokphand Indonesia Tbk

PT Wonokoyo Jaya Corp 23.470.724 12.276.704 PT Wonokoyo Jaya Corp Total 402.513.525 226.185.061 Total

PT Bangkit Setia Sentosa 22.628.862 10.172.254 PT Bangkit Setia Sentosa

PT Starindo Jaya Packaging 19.131.450 14.626.628 PT Starindo Jaya Packaging

PD Kartika Eka Dharma 14.250.451 9.304.603 PD Kartika Eka Dharma Rincian utang lain-lain berdasarkan mata uang The details of other payables based on currency are

PT Salmart Retailindo Internasional 12.472.492 - PT Salmart Retailindo Internasional adalah sebagai berikut: as follows:

PT Coca-Cola Distribution Indonesia 9.120.257 9.828.608 PT Coca-Cola Distribution Indonesia

PT Padi Organik Indonesia 8.248.495 5.503.680 PT Padi Organik Indonesia 31 Desember 2023/ 31 Desember 2022/

December 31, 2023 December 31, 2022

PT Artha Karya Utama Indonesia 8.205.755 8.698.982 PT Artha Kaya Utama Indonesia

PT Expravet Nasuba 7.496.385 4.297.409 PT Expravet Nasuba Pihak ketiga Third parties

PT Smart Tbk 7.444.604 6.905.599 PT Smart Tbk Rupiah 344.570.530 225.686.388 Rupiah

PT Wilmar Nabati Indonesia 7.374.820 15.189.794 PT Wilmar Nabati Indonesia Dolar AS 57.547.958 498.673 US Dollar

PT Induksarana Kemasindo 6.405.696 4.337.808 PT Induksarana Kemasindo

PT Solo Murni 5.939.212 3.941.535 PT Solo Murni Sub-total 402.118.488 226.185.061 Sub-total

PT Tirta Investama 5.430.010 2.563.949 PT Tirta Investama Pihak berelasi (Catatan 29d) Related parties (Note 29d)

PT Saliman Riyanto 5.203.373 5.656.730 PT Saliman Riyanto Rupiah 395.037 - Rupiah

Lain-lain (masing-masing

di bawah Rp5.000.000) 130.354.860 133.747.139 Others (each below Rp5,000,000) Total 402.513.525 226.185.061 Total

Sub-total 437.514.431 354.446.990 Sub-total

Pihak berelasi (Catatan 29c) 64.917.902 51.904.780 Related parties (Note 29c) Utang lain-lain tidak dijamin, tidak dibebani bunga Other payables are unsecured, non-interest bearing

dan penyelesaiannya akan dilakukan secara and the settlement will be in cash.

Total 502.432.333 406.351.770 Total

tunai.

Utang usaha tidak dijamin, tidak dikenakan bunga Trade payables are not guaranteed, non-interest 16. PERPAJAKAN 16. TAXATION

dan penyelesaiannya akan dilakukan secara bearing and the settlement will be in cash. a. Utang pajak a. Taxes payable

tunai.

Utang pajak terdiri dari: Taxes payable consists of:

Analisa umur utang usaha adalah sebagai berikut: The aging analysis of trade payables are as follows:

31 Desember 2023/ 31 Desember 2022/

31 Desember 2023/ 31 Desember 2022/

December 31, 2023 December 31, 2022 December 31, 2023 December 31, 2022

Lancar 154.017.754 218.097.216 Current Pajak restoran (PB I) 74.689.071 58.987.285 Restaurant tax (PB I)

Telah jatuh tempo: Overdue: Pajak penghasilan pasal 21 24.239.507 11.810.581 Income tax article 21

1 - 30 hari 142.905.952 128.631.139 1 - 30 days Pajak penghasilan pasal 23 dan 4(2) 12.998.848 8.395.559 Income tax article 23 and 4(2)

31 - 60 hari 143.655.147 41.457.954 31 - 60 days Pajak penghasilan pasal 26 11.116.174 27.599.205 Income tax article 26

Lebih dari 60 hari 61.853.480 18.165.461 More than 60 days Pajak pertambahan nilai 9.088.770 6.784.271 Value added tax

Total 502.432.333 406.351.770 Total Total 132.132.370 113.576.901 Total

60 61