Page 242 - KFC Annual Report 2018

P. 242

LAPORAN KEUANGAN 2018

Financial Statements 2018

The original financial statements included The original financial statements included

herein are in Indonesian language. herein are in Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2018 dan untuk As of December 31, 2018 Tanggal 31 Desember 2018 dan untuk As of December 31, 2018

Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended

(Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah, (Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah,

Kecuali Dinyatakan Lain) Unless Otherwise Stated) Kecuali Dinyatakan Lain) Unless Otherwise Stated)

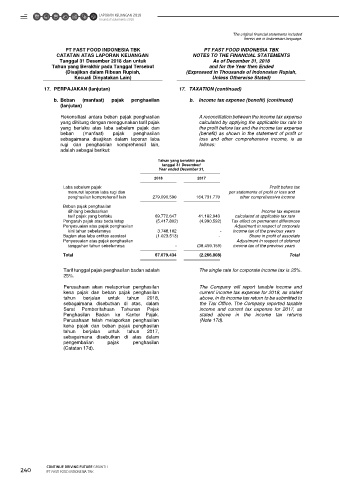

17. PERPAJAKAN (lanjutan) 17. TAXATION (continued) 17. PERPAJAKAN (lanjutan) 17. TAXATION (continued)

b. Beban (manfaat) pajak penghasilan b. Income tax expense (benefit) (continued) c. Aset/(liabilitas) pajak tangguhan c. Deferred tax assets/(liabilities)

(lanjutan)

Mutasi atas aset/(liabilitas) pajak tangguhan The movement of deferred tax assets/(liabilities)

Rekonsiliasi antara beban pajak penghasilan A reconciliation between the income tax expense adalah sebagai berikut: are as follows:

yang dihitung dengan menggunakan tarif pajak calculated by applying the applicable tax rate to

yang berlaku atas laba sebelum pajak dan the profit before tax and the income tax expense Dibebankan

Dikreditkan ke Penghasilan

beban (manfaat) pajak penghasilan (benefit) as shown in the statement of profit or (Dibebankan) ke Komprehensif

sebagaimana disajikan dalam laporan laba loss and other comprehensive income, is as 31 Desember Laba Rugi/ Lain/Credited 31 Desember

2017/

Credited

2018/

to Other

rugi dan penghasilan komprehensif lain, follows: December 31, (Charged) to Comprehensive December 31,

adalah sebagai berikut: 2017 Profit or Loss Income 2018

Liabilitas imbalan kerja 157.809.059 13.571.413 (28.265.325) 143.115.147 Employee benefits liability

Tahun yang berakhir pada Biaya renovasi dan Deferred renovation and

tanggal 31 Desember/ restorasi bangunan restoration costs of

Year ended December 31, sewa ditangguhkan (61.429.493) 2.914.868 - (58.514.625) rented buildings

Aset tetap (32.627.966) (1.933.452) - (34.561.418) Fixed assets

Beban ditangguhkan (14.965.022) (1.595.391) - (16.560.413) Deferred charges

2018 2017 Aset sewa pembiayaan (185.405) (329.450) - (514.855) Assets under finance leases

Penyisihan atas Provision for impairment

Laba sebelum pajak Profit before tax penurunan nilai piutang - 4.875.000 - 4.875.000 of receivables

menurut laporan laba rugi dan per statements of profit or loss and

Total 48.601.173 17.502.988 (28.265.325) 37.838.836 Total

penghasilan komprehensif lain 279.090.590 164.731.770 other comprehensive income

Beban pajak penghasilan Penyesuaian

dihitung berdasarkan Income tax expense atas Pajak

tarif pajak yang berlaku 69.772.647 41.182.943 calculated at applicable tax rate Tangguhan

Dikreditkan Tahun

Pengaruh pajak atas beda tetap (5.417.802) (4.990.592) Tax effect on permanent differences Dikreditkan ke Penghasilan Sebelumnya/

Penyesuaian atas pajak penghasilan Adjustment in respect of corporate (Dibebankan) ke Komprehensif Adjustment in

Respect of

kini tahun sebelumnya 3.748.102 - income tax of the previous years 31 Desember Laba Rugi/ Lain/Credited Deferred Income 31 Desember

2016/

Credited

to Other

2017/

Bagian atas laba entitas asosiasi (1.023.513) - Share in profit of associate December 31, (Charged) to Comprehensive Tax of December 31,

Penyesuaian atas pajak penghasilan Adjustment in respect of deferred 2016 Profit or Loss Income Previous Years 2017

tangguhan tahun sebelumnya - (38.459.159) income tax of the previous years

Liabilitas imbalan kerja 125.467.269 16.755.027 15.586.763 - 157.809.059 Employee benefits liability

Biaya renovasi dan Deferred renovation and

Total 67.079.434 (2.266.808) Total restorasi bangunan restoration costs of

sewa ditangguhkan (101.044.454) 3.328.614 - 36.286.347 (61.429.493) rented buildings

Aset tetap (33.419.018) (1.381.760) - 2.172.812 (32.627.966) Fixed assets

Beban ditangguhkan (12.724.746) (2.240.276) - - (14.965.022) Deferred charges

Tarif tunggal pajak penghasilan badan adalah The single rate for corporate income tax is 25%. Aset sewa pembiayaan (498.533) 313.128 - - (185.405) Assets under finance leases

25%. Total (22.219.482) 16.774.733 15.586.763 38.459.159 48.601.173 Total

Perusahaan akan melaporkan penghasilan The Company will report taxable income and

kena pajak dan beban pajak penghasilan current income tax expense for 2018, as stated d. Pajak penghasilan badan 2016 dan 2017 d. Corporate income tax 2016 and 2017

tahun berjalan untuk tahun 2018, above, in its income tax return to be submitted to

sebagaimana disebutkan di atas, dalam the Tax Office. The Company reported taxable Pada bulan September 2018, Perusahaan In September 2018, the Company made

Surat Pemberitahuan Tahunan Pajak income and current tax expense for 2017, as melakukan pembetulan atas pajak corrections for 2016 and 2017 corporate income

Penghasilan Badan ke Kantor Pajak. stated above in the income tax returns penghasilan badan tahun pajak 2016 dan tax, reported underpayment amounted to

Perusahaan telah melaporkan penghasilan (Note 17d). 2017, dengan melaporkan kekurangan Rp1,485,055 and Rp2,263,047, respectively,

kena pajak dan beban pajak penghasilan pembayaran masing-masing sebesar with the related interest amounted to Rp504,919

tahun berjalan untuk tahun 2017, Rp1.485.055 dan Rp2.263.047 beserta and Rp226,305, respectively. The Company has

sebagaimana disebutkan di atas dalam bunga keterlambatan terkait masing-masing fully paid such tax underpayment in September

pengembalian pajak penghasilan sebesar Rp504.919 dan Rp226.305. Seluruh 2018 and was charged as tax expense in 2018,

(Catatan 17d). kekurangan pembayaran pajak tersebut telah while its interest was charged as operating

dibayar pada bulan September 2018 dan expenses in 2018.

dibebankan sebagai beban pajak tahun 2018,

sedangkan bunganya dibebankan sebagai

beban operasional tahun 2018.

54 55

240 CONTINUE DRIVING FUTURE GROWTH

PT FAST FOOD INDONESIA TBK