Page 240 - KFC Annual Report 2018

P. 240

LAPORAN KEUANGAN 2018

Financial Statements 2018

The original financial statements included The original financial statements included

herein are in Indonesian language. herein are in Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2018 dan untuk As of December 31, 2018 Tanggal 31 Desember 2018 dan untuk As of December 31, 2018

Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended

(Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah, (Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah,

Kecuali Dinyatakan Lain) Unless Otherwise Stated) Kecuali Dinyatakan Lain) Unless Otherwise Stated)

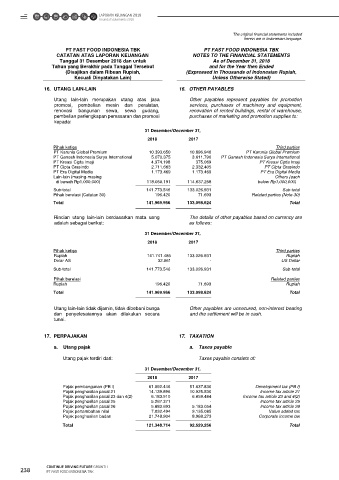

16. UTANG LAIN-LAIN 16. OTHER PAYABLES 17. PERPAJAKAN (lanjutan) 17. TAXATION (continued)

Utang lain-lain merupakan utang atas jasa Other payables represent payables for promotion b. Beban (manfaat) pajak penghasilan b. Income tax expense (benefit)

promosi, pembelian mesin dan peralatan, services, purchases of machinery and equipment,

renovasi bangunan sewa, sewa gudang, renovation of rented buildings, rental of warehouse, Rincian beban (manfaat) pajak penghasilan The details of income tax expense (benefit) are

pembelian perlengkapan pemasaran dan promosi purchases of marketing and promotion supplies to: adalah sebagai berikut: as follows:

kepada:

Tahun yang berakhir pada

tanggal 31 Desember/

31 Desember/December 31, Year ended December 31,

2018 2017

2018 2017

Pihak ketiga Third parties

PT Karunia Global Premium 10.393.650 10.896.940 PT Karunia Global Premium Pajak penghasilan kini Corporate income tax

PT Ganesh Indonesia Surya International 5.070.375 3.611.790 PT Ganesh Indonesia Surya International Tahun berjalan 80.834.320 52.967.084 Current year

PT Kreasi Cipta Imaji 4.374.198 375.069 PT Kreasi Cipta Imaji Penyesuaian Adjustment in respect of

PT Cipta Grasindo 2.711.663 2.332.405 PT Cipta Grasindo tahun sebelumnya 3.748.102 - the previous years

PT Era Digital Media 1.173.469 1.173.469 PT Era Digital Media

Lain-lain (masing-masing Others (each Pajak penghasilan tangguhan Deferred income tax

di bawah Rp1.000.000) 118.050.191 114.637.258 below Rp1,000,000) Tahun berjalan (17.502.988) (16.774.733) Current year

Penyesuaian Adjustment in respect of

Sub-total 141.773.546 133.026.931 Sub-total tahun sebelumnya - (38.459.159) the previous years

Pihak berelasi (Catatan 30) 196.420 71.693 Related parties (Note 30)

Beban (manfaat)

Total 141.969.966 133.098.624 Total pajak penghasilan, neto 67.079.434 (2.266.808) Income tax expense (benefit), net

Rincian utang lain-lain berdasarkan mata uang The details of other payables based on currency are Penghitungan pajak penghasilan kini adalah The calculation of corporate income tax is as

adalah sebagai berikut: as follows: sebagai berikut: follows:

31 Desember/December 31, Tahun yang berakhir pada

tanggal 31 Desember/

2018 2017 Year ended December 31,

Pihak ketiga Third parties 2018 2017

Rupiah 141.741.485 133.026.931 Rupiah

Dolar AS 32.061 - US Dollar Laba sebelum pajak Profit before tax

menurut laporan laba rugi dan per statement of profit or loss and

Sub-total 141.773.546 133.026.931 Sub-total penghasilan komprehensif lain 279.090.590 164.731.770 other comprehensive income

Pihak berelasi Related parties Perbedaan tetap Permanent differences

Rupiah 196.420 71.693 Rupiah Beban yang tidak

dapat dikurangkan 9.496.867 9.197.267 Non-deductible expenses

Total 141.969.966 133.098.624 Total

Pendapatan yang telah

dikenakan pajak final: Income subjected to final tax:

Penghasilan bunga (27.097.674) (28.191.150) Interest income

Utang lain-lain tidak dijamin, tidak dibebani bunga Other payables are unsecured, non-interest bearing Penghasilan sewa (4.070.402) (968.480) Rent income

dan penyelesaiannya akan dilakukan secara and the settlement will be in cash.

tunai. Perbedaan temporer Temporary differences

Penyisihan atas imbalan kerja 54.285.652 67.020.104 Provision for employee benefits

Amortisasi biaya renovasi Amortization of deferred renovation

bangunan sewa ditangguhkan 11.659.472 13.314.456 costs of rented buildings

17. PERPAJAKAN 17. TAXATION

Amortisasi beban ditangguhkan (6.381.564) (8.961.104) Amortization of deferred charges

Penyusutan aset tetap (7.733.809) (5.527.040) Depreciation of fixed assets

a. Utang pajak a. Taxes payable Bagian atas laba entitas asosiasi (4.094.052) - Share in profit of associate

Aset sewa pembiayaan (1.317.799) 1.252.512 Assets under finance leases

Utang pajak terdiri dari: Taxes payable consists of: Penyisihan penurunan

nilai atas piutang 19.500.000 - Provision for impairment of receivables

31 Desember/December 31,

Penghasilan kena pajak 323.337.281 211.868.335 Taxable income

2018 2017 Beban pajak penghasilan - kini (80.834.320) (52.967.084) Income tax expense - current

Pajak pembangunan (PB I) 61.092.446 51.637.830 Development tax (PB I) Dikurangi pajak dibayar di muka: Less prepaid taxes:

Pajak penghasilan pasal 21 14.139.896 10.925.530 Income tax article 21 Pajak penghasilan pasal 23 4.615.638 1.000.819 Income tax article 23

Pajak penghasilan pasal 23 dan 4(2) 6.183.910 6.659.484 Income tax article 23 and 4(2) Pajak penghasilan pasal 25 54.469.778 42.977.992 Income tax article 25

Pajak penghasilan pasal 25 5.267.371 - Income tax article 25

Pajak penghasilan pasal 26 5.883.693 5.183.054 Income tax article 26 Total pajak dibayar di muka 59.085.416 43.978.811 Total prepaid taxes

Pajak pertambahan nilai 7.032.494 9.135.085 Value added tax Utang pajak penghasilan badan (21.748.904) (8.988.273) Corporate income tax payable

Pajak penghasilan badan 21.748.904 8.988.273 Corporate income tax

Total 121.348.714 92.529.256 Total

52 53

238 CONTINUE DRIVING FUTURE GROWTH

PT FAST FOOD INDONESIA TBK