Page 378 - AR SR FFI 2023_0805_Low

P. 378

The original financial statements included The original financial statements included

herein are in the Indonesian language. herein are in the Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued) KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued)

Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah, (Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated) kecuali dinyatakan lain) unless otherwise stated)

32. TUJUAN DAN KEBIJAKAN MANAJEMEN 32. FINANCIAL RISK MANAGEMENT OBJECTIVES 34. INFORMASI SEGMEN 34. SEGMENT INFORMATION

RISIKO KEUANGAN (lanjutan) AND POLICIES (continued)

Untuk tujuan manajemen, Perusahaan dikelola For management purposes, the Company is

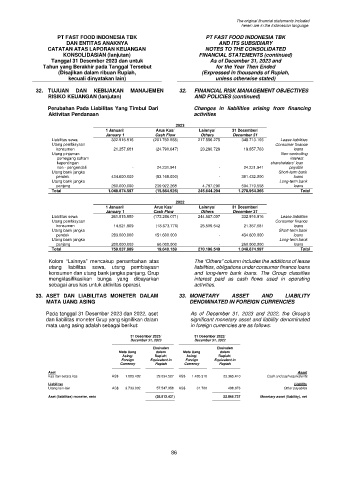

Perubahan Pada Liabilitas Yang Timbul Dari Changes in liabilities arising from financing dan diklasifikasikan aktivitas usahanya secara managed and classified its business geographically,

Aktivitas Pendanaan activities geografis yang terdiri dari Restaurant Support which consists of Jakarta, Medan, Batam, Makassar,

Center (“RSC”) Jakarta, Medan, Batam, Bandung, Semarang, Surabaya, Bali, Palembang

2023 Makassar, Bandung, Semarang, Surabaya, Bali, and Balikpapan Restaurant Support Center (“RSC”).

1 Januari/ Arus Kas/ Lainnya/ 31 Desember/ Palembang dan Balikpapan. RSC yang disajikan Jakarta RSC, Medan RSC, Makassar RSC,

January 1 Cash Flow Others December 31

Liabilitas sewa 332.916.916 (201.760.088) 217.556.275 348.713.103 Lease liabilities terpisah dalam pelaporan informasi segmen Palembang RSC and Bandung RSC are presented

Utang pembiayaan Consumer finance operasi adalah RSC Jakarta, RSC Medan, RSC separately as segments in operating segment

konsumen 21.357.681 (24.790.647) 23.290.729 19.857.763 loans Makassar, RSC Palembang dan RSC Bandung. information.

Utang pinjaman Non-controlling

pemegang saham interest

kepentingan shareholders’ loan Segmen operasi Operating segments

non - pengendali - 24.231.941 - 24.231.941 payable

Utang bank jangka Short-term bank Manajemen memantau hasil operasi dari unit Management monitors the operating results of its

pendek 434.600.000 (53.168.000) - 381.432.000 loans

Utang bank jangka Long-term bank usahanya secara terpisah guna keperluan business units separately for the purpose of making

panjang 260.000.000 239.922.268 4.797.290 504.719.558 loans pengambilan keputusan mengenai alokasi decisions about resource allocation and performance

Total 1.048.874.597 (15.564.526) 245.644.294 1.278.954.365 Total sumber daya dan penilaian kinerja. Kinerja assessment. Segment performance is evaluated

segmen dievaluasi berdasarkan laba atau rugi based on operating profit or loss and is measured

2022 operasi dan diukur secara konsisten dengan laba consistently with operating profit or loss in the

1 Januari/ Arus Kas/ Lainnya/ 31 Desember/ atau rugi operasi pada laporan keuangan consolidated financial statements. However, the

January 1 Cash Flow Others December 31

Liabilitas sewa 261.515.980 (173.286.071) 244.687.007 332.916.916 Lease liabilities konsolidasian. Namun, pendanaan (termasuk Group’s financing (including finance costs and

Utang pembiayaan Consumer finance beban keuangan dan penghasilan keuangan) dan finance income) and income taxes are managed on

konsumen 14.521.909 (18.673.770) 25.509.542 21.357.681 loans pajak penghasilan dikelola secara kesatuan grup a group basis and are not allocated to operating

Utang bank jangka Short-term bank dan tidak dialokasikan kepada segmen operasi. segments.

pendek 283.000.000 151.600.000 - 434.600.000 loans

Utang bank jangka Long-term bank

panjang 200.000.000 60.000.000 - 260.000.000 loans Tabel berikut ini menyajikan informasi The following table presents revenues and profit, and

Total 759.037.889 19.640.159 270.196.549 1.048.874.597 Total pendapatan dan laba, serta aset dan liabilitas asset and liability information regarding the

sehubungan dengan segmen operasi Company’s operating segments:

Kolom “Lainnya” mencakup penambahan atas The “Others” column includes the additions of lease Perusahaan:

utang liabilitas sewa, utang pembiayaan liabilities, obligations under consumer finance loans

konsumen dan utang bank jangka panjang. Grup and long-term bank loans. The Group classifies Tanggal 31 Desember 2023/

As of December 31, 2023

mengklasifikasikan bunga yang dibayarkan interest paid as cash flows used in operating

sebagai arus kas untuk aktivitas operasi. activities. RSC Jakarta/ RSC Medan/ RSC Makassar/ RSC Palembang/ RSC Bandung/ RSC Lainnya/ JAI/ Total/

Jakarta RSC Medan RSC Makassar RSC Palembang RSC Bandung RSC Others RSC JAI Total

33. ASET DAN LIABILITAS MONETER DALAM 33. MONETARY ASSET AND LIABILITY Pendapatan 2.176.172.327 403.936.505 721.516.732 425.309.702 427.076.632 1.780.992.794 - 5.935.004.692 Segment assets

MATA UANG ASING DENOMINATED IN FOREIGN CURRENCIES Beban pokok

penjualan (825.742.395) (157.703.197) (279.974.291) (165.731.321) (157.910.768) (682.545.319) - (2.269.607.291) Cost of goods sold

Pada tanggal 31 Desember 2023 dan 2022, aset As of December 31, 2023 and 2022, the Group’s Laba bruto 1.350.429.932 246.233.308 441.542.441 259.578.381 269.165.864 1.098.447.475 - 3.665.397.401 Gross profit

dan liabilitas moneter Grup yang signifikan dalam significant monetary asset and liability denominated Beban operasi yang Allocated

dapat dialokasikan (1.115.491.966) (184.260.115) (290.440.995) (194.783.098) (203.403.275) (835.175.485) - (2.823.554.934) operating expenses

mata uang asing adalah sebagai berikut: in foreign currencies are as follows:

Hasil segmen 234.937.966 61.973.193 151.101.446 64.795.283 65.762.589 263.271.990 - 841.842.467 Segment result

31 Desember 2023/ 31 Desember 2022/

December 31, 2023 December 31, 2022 Beban operasi yang

tidak dapat Unallocated

Ekuivalen Ekuivalen dialokasikan (1.143.776.818) operating expenses

Mata Uang dalam Mata Uang dalam

Asing/ Rupiah/ Asing/ Rupiah/ Rugi usaha (301.934.351) Operating loss

Foreign Equivalent in Foreign Equivalent in

Currency Rupiah Currency Rupiah Beban keuangan,

neto (68.913.991) Finance cost, net

Aset Asset Bagian atas laba Share in profit of

Kas dan setara kas AS$ 1.883.402 29.034.527 AS$ 1.485.310 23.365.410 Cash and cash equivalents entitas asosiasi 926.494 associate

Liabilitas Liability Rugi sebelum pajak Loss before

Utang lain-lain AS$ 3.733.002 57.547.958 AS$ 31.700 498.673 Other payables penghasilan (369.921.848) income tax

Pajak penghasilan (48.290.563) Income tax

Aset (liabilitas) moneter, neto (28.513.431) 22.866.737 Monetary asset (liability), net

Rugi tahun berjalan (418.212.411) Loss for the year

86 87