Page 286 - Artwork AR SR FFI (KFC) Revised_2022.V.1.08.05.2023_compressed

P. 286

IKHTISAR KINERJA UTAMA LAPORAN MANAJEMEN PROFIL PERUSAHAAN

PERFORMANCE HIGHLIGHTS MANAGEMENT REPORTS COMPANY PROFILE

The original financial statements included

herein are in the Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Untuk Tahun yang Berakhir pada Tanggal For the Year than Ended

31 Desember 2022 December 31, 2022

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

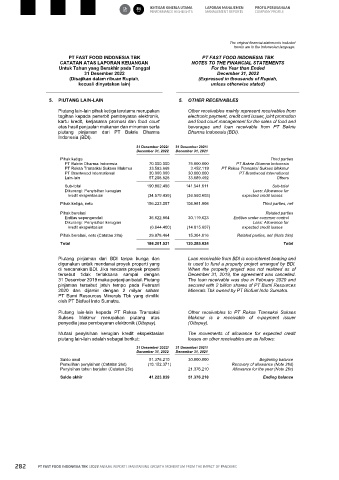

5. PIUTANG LAIN-LAIN 5. OTHER RECEIVABLES

Piutang lain-lain pihak ketiga terutama merupakan Other receivables mainly represent receivables from

tagihan kepada penerbit pembayaran elektronik, electronic payment, credit card issuer, joint promotion

kartu kredit, kerjasama promosi dan food court and food court management for the sales of food and

atas hasil penjualan makanan dan minuman serta beverages and loan receivable from PT Bakrie

piutang pinjaman dari PT Bakrie Dharma Dharma Indonesia (BDI).

Indonesia (BDI).

31 Desember 2022/ 31 Desember 2021/

December 31, 2022 December 31, 2021

Pihak ketiga Third parties

PT Bakrie Dharma Indonesia 70.000.000 75.000.000 PT Bakrie Dharma Indonesia

PT Reksa Transaksi Sukses Makmur 33.593.668 3.452.119 PT Reksa Transaksi Sukses Makmur

PT Brantwood International 30.000.000 30.000.000 PT Brantwood International

Lain-lain 57.208.828 33.089.492 Others

Sub-total 190.802.496 141.541.611 Sub-total

Dikurangi: Penyisihan kerugian Less: Allowance for

kredit ekspektasian (34.579.439) (36.560.603) expected credit losses

Pihak ketiga, neto 156.223.057 104.981.008 Third parties, net

Pihak berelasi Related parties

Entitas sepengendali 36.622.864 30.119.623 Entities under common control

Dikurangi: Penyisihan kerugian Less: Allowance for

kredit ekspektasian (6.644.400) (14.815.607) expected credit losses

Pihak berelasi, neto (Catatan 28a) 29.978.464 15.304.016 Related parties, net (Note 28a)

Total 186.201.521 120.285.024 Total

Piutang pinjaman dari BDI tanpa bunga dan Loan receivable from BDI is non-interest bearing and

digunakan untuk mendanai proyek properti yang is used to fund a property project arranged by BDI.

di rencanakan BDI. Jika rencana proyek properti When the property project was not realized as of

tersebut tidak terlaksana sampai dengan December 31, 2019, the agreement was cancelled.

31 Desember 2019 maka perjanjian batal. Piutang The loan receivable was due in February 2020 and

pinjaman tersebut jatuh tempo pada Februari secured with 2 billion shares of PT Bumi Resources

2020 dan dijamin dengan 2 milyar saham Minerals Tbk owned by PT Biofuel Indo Sumatra.

PT Bumi Resources Minerals Tbk yang dimiliki

oleh PT Biofuel Indo Sumatra.

Piutang lain-lain kepada PT Reksa Transaksi Other receivables to PT Reksa Transaksi Sukses

Sukses Makmur merupakan piutang atas Makmur is a receivable of e-payment issuer

penyedia jasa pembayaran elektronik (Ottopay). (Ottopay).

Mutasi penyisihan kerugian kredit ekspektasian The movements of allowance for expected credit

piutang lain-lain adalah sebagai berikut: losses on other receivables are as follows:

31 Desember 2022/ 31 Desember 2021/

December 31, 2022 December 31, 2021

Saldo awal 51.376.210 30.000.000 Beginning balance

Pemulihan penyisihan (Catatan 26d) (10.152.371) - Recovery of allowance (Note 26d)

Penyisihan tahun berjalan (Catatan 26c) - 21.376.210 Allowance for the year (Note 26c)

Saldo akhir 41.223.839 51.376.210 Ending balance

49

282 PT FAST FOOD INDONESIA TBK | 2022 ANNUAL REPORT | MAINTAINING GROWTH MOMENTUM FROM THE IMPACT OF PANDEMIC