Page 295 - KFC Annual Report 2017

P. 295

TATA KELOLA PERUSAHAAN TANGGUNG JAWAB SOSIAL PERUSAHAAN LAPORAN KEUANGAN

Corporate Governance Corporate Social Responsibility Financial Statement

The original financial statements included

herein are in Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Tanggal 31 Desember 2017 dan untuk As of December 31, 2017

Tahun yang Berakhir pada Tanggal Tersebut and for the Year then Ended

(Disajikan dalam Ribuan Rupiah, (Expressed in Thousands of Indonesian Rupiah,

Kecuali Dinyatakan Lain) Unless Otherwise Stated)

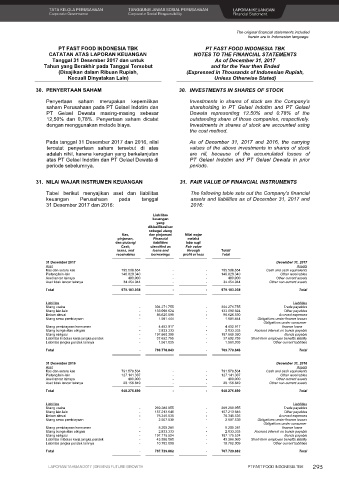

30. PENYERTAAN SAHAM 30. INVESTMENTS IN SHARES OF STOCK

Penyertaan saham merupakan kepemilikan Investments in shares of stock are the Company’s

saham Perusahaan pada PT Gelael Indotim dan shareholding in PT Gelael Indotim and PT Gelael

PT Gelael Dewata masing-masing sebesar Dewata representing 12.50% and 0.78% of the

12,50% dan 0,78%. Penyertaan saham dicatat outstanding share of those companies, respectively.

dengan menggunakan metode biaya. Investments in shares of stock are accounted using

the cost method.

Pada tanggal 31 Desember 2017 dan 2016, nilai As of December 31, 2017 and 2016, the carrying

tercatat penyertaan saham tersebut di atas values of the above investments in shares of stock

adalah nihil, karena kerugian yang berkelanjutan are nil, because of the accumulated losses of

atas PT Gelael Indotim dan PT Gelael Dewata di PT Gelael Indotim and PT Gelael Dewata in prior

periode sebelumnya. periods.

31. NILAI WAJAR INSTRUMEN KEUANGAN 31. FAIR VALUE OF FINANCIAL INSTRUMENTS

Tabel berikut menyajikan aset dan liabilitas The following table sets out the Company’s financial

keuangan Perusahaan pada tanggal assets and liabilities as of December 31, 2017 and

31 Desember 2017 dan 2016: 2016:

Liabilitas

keuangan

yang

diklasifikasikan

sebagai utang

Kas, dan pinjaman/ Nilai wajar

pinjaman, Financial melalui

dan piutang/ liabilities laba rugi/

Cash, classified as Fair value

loans, and loans and through Total/

receivables borrowings profit or loss Total

31 Desember 2017 December 31, 2017

Aset Assets

Kas dan setara kas 795.508.654 - - 795.508.654 Cash and cash equivalents

Piutang lain-lain 148.820.340 - - 148.820.340 Other receivables

Aset lancar lainnya 400.000 - - 400.000 Other current assets

Aset tidak lancar lainnya 34.454.044 - - 34.454.044 Other non-current assets

Total 979.183.038 - - 979.183.038 Total

Liabilitas Liabilities

Utang usaha - 304.271.755 - 304.271.755 Trade payables

Utang lain-lain - 133.098.624 - 133.098.624 Other payables

Beban akrual - 86.626.590 - 86.626.590 Accrued expenses

Utang sewa pembiayaan - 1.581.444 - 1.581.444 Obligations under finance leases

Obligations under consumer

Utang pembiayaan konsumen - 4.452.917 - 4.452.917 finance loans

Utang bunga atas obligasi - 2.833.333 - 2.833.333 Accrued interest on bonds payable

Utang obligasi - 197.660.390 - 197.660.390 Bonds payable

Liabilitas imbalan kerja jangka pendek - 37.692.755 - 37.692.755 Short-term employee benefits liability

Liabilitas jangka pendek lainnya - 1.561.035 - 1.561.035 Other current liabilities

Total - 769.778.843 - 769.778.843 Total

31 Desember 2016 December 31, 2016

Aset Assets

Kas dan setara kas 791.578.534 - - 791.578.534 Cash and cash equivalents

Piutang lain-lain 127.141.307 - - 127.141.307 Other receivables

Aset lancar lainnya 400.000 - - 400.000 Other current assets

Aset tidak lancar lainnya 29.156.849 - - 29.156.849 Other non-current assets

Total 948.276.690 - - 948.276.690 Total

Liabilitas Liabilities

Utang usaha - 269.280.955 - 269.280.955 Trade payables

Utang lain-lain - 157.213.646 - 157.213.646 Other payables

Beban akrual - 76.345.535 - 76.345.535 Accrued expenses

Utang sewa pembiayaan - 2.507.539 - 2.507.539 Obligations under finance leases

Obligations under consumer

Utang pembiayaan konsumen - 8.205.281 - 8.205.281 finance loans

Utang bunga atas obligasi - 2.833.333 - 2.833.333 Accrued interest on bonds payable

Utang obligasi - 197.175.524 - 197.175.524 Bonds payable

Liabilitas imbalan kerja jangka pendek - 43.386.060 - 43.386.060 Short-term employee benefits liability

Liabilitas jangka pendek lainnya - 10.782.009 - 10.782.009 Other current liabilities

Total - 767.729.882 - 767.729.882 Total

70

LAPORAN TAHUAN 2017 | DRIVING FUTURE GROWTH PT FAST FOOD INDONESIA TBK 293