Page 346 - AR SR FFI 2023_0805_Low

P. 346

The original financial statements included The original financial statements included

herein are in the Indonesian language. herein are in the Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY DAN ENTITAS ANAKNYA AND ITS SUBSIDIARY

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE CONSOLIDATED

KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued) KONSOLIDASIAN (lanjutan) FINANCIAL STATEMENTS (continued)

Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and Tanggal 31 Desember 2023 dan untuk As of December 31, 2023 and

Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended Tahun yang Berakhir pada Tanggal Tersebut for the Year Then Ended

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah, (Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated) kecuali dinyatakan lain) unless otherwise stated)

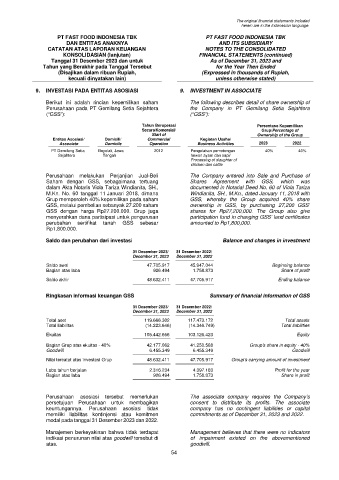

9. INVESTASI PADA ENTITAS ASOSIASI 9. INVESTMENT IN ASSOCIATE 10. ASET TETAP, NETO 10. FIXED ASSETS, NET

Berikut ini adalah rincian kepemilikan saham The following describes detail of share ownership of Rincian mutasi dari aset tetap adalah sebagai The details of the movements of fixed assets are as

Perusahaan pada PT Gemilang Setia Sejahtera the Company in PT Gemilang Setia Sejahtera berikut: follows:

(“GSS”): (“GSS”):

Saldo Awal/ Saldo Akhir/

Tahun Beroperasi Persentase Kepemilikan Beginning Penambahan/ Pengurangan/ Reklasifikasi/ Ending

Secara Komersial/ Grup/Percentage of 31 Desember 2023 Balance Additions Deductions Reclassification Balance December 31, 2023

Start of Ownership of the Group Biaya perolehan Cost

Entitas Asosiasi/ Domisili/ Commercial Kegiatan Usaha/ Tanah 168.895.370 190.917.590 - - 359.812.960 Land

Associate Domicile Operation Business Activities 2023 2022

Bangunan 56.604.072 - - - 56.604.072 Buildings

PT Gemilang Setia Boyolali, Jawa 2012 Pengolahan pemotongan 40% 40% Mesin dan peralatan 1.126.335.507 67.083.627 (8.157.307) - 1.185.261.827 Machineries and equipment

Sejahtera Tengah hewan ayam dan sapi/ Kendaraan bermotor 218.732.972 37.473.761 (18.182.519) - 238.024.214 Motor vehicles

Processing of slaughter of Perabotan dan Furniture, fixtures and

chicken dan cattle peralatan kantor 180.168.816 9.526.996 (1.608.252) - 188.087.560 office equipment

Sub-total 1.750.736.737 305.001.974 (27.948.078) - 2.027.790.633 Sub-total

Perusahaan melakukan Perjanjian Jual-Beli The Company entered into Sale and Purchase of Aset tetap dalam

Saham dengan GSS, sebagaimana tertuang Shares Agreement with GSS, which was penyelesaian - 105.786.982 - - 105.786.982 Construction in-progress

dalam Akta Notaris Viola Tariza Windianita, SH., documented in Notarial Deed No. 60 of Viola Tariza Total biaya perolehan 1.750.736.737 410.788.956 * (27.948.078) - 2.133.577.615 Total cost

M.Kn. No. 60 tanggal 11 Januari 2018, dimana Windianita, SH., M.Kn., dated January 11, 2018 with

Grup memperoleh 40% kepemilikan pada saham GSS, whereby the Group acquired 40% share Akumulasi penyusutan Accumulated depreciation

GSS, melalui pembelian sebanyak 27.200 saham ownership in GSS, by purchasing 27,200 GSS’ Bangunan 33.320.467 1.944.202 - - 35.264.669 Buildings

Mesin dan peralatan 787.647.292 75.905.048 (5.888.454) 857.663.886 Machineries and equipment

GSS dengan harga Rp27.200.000. Grup juga shares for Rp27,200,000. The Group also give

Kendaraan bermotor 149.043.135 26.328.260 (15.272.558 ) - 160.098.837 Motor vehicles

menyerahkan dana partisipasi untuk pengurusan participation fund in changing GSS’ land certificates Perabotan dan Furniture, fixtures and

perubahan sertifikat tanah GSS sebesar amounted to Rp1,800,000. peralatan kantor 162.591.803 10.158.765 (1.484.755) - 171.265.813 office equipment

Rp1.800.000. Total akumulasi Total accumulated

penyusutan 1.132.602.697 114.336.275 * (22.645.767) - 1.224.293.205 depreciation

Saldo dan perubahan dari investasi Balance and changes in investment Nilai tercatat neto 618.134.040 909.284.410 Net carrying amount

31 Desember 2023/ 31 Desember 2022/

December 31, 2023 December 31, 2022 *) Termasuk reklasifikasi saldo awal biaya perolehan dan akumulasi penyusutan dari JAI masing-masing sebesar Rp93.624 dan Rp7.397 dan

reklasifikasi biaya perolehan dan akumulasi penyusutan dari aset hak-guna masing-masing sebesar Rp895.000 dan Rp507.157/

Saldo awal 47.705.917 45.947.044 Beginning balance include reclassifications of beginning balance of cost and accumulated depreciation from JAI amounting to Rp93,624 and Rp7,397, respectively and

Bagian atas laba 926.494 1.758.873 Share of profit reclassifications of cost and accumulated depreciation from right-of-use assets amounting to Rp895,000 and Rp507,157, respectively.

Saldo akhir 48.632.411 47.705.917 Ending balance Saldo Awal/ Saldo Akhir/

Beginning Penambahan/ Pengurangan/ Reklasifikasi/ Ending

31 Desember 2022 Balance Additions Deductions Reclassification Balance December 31, 2022

Ringkasan informasi keuangan GSS Summary of financial information of GSS Biaya perolehan Cost

Tanah 163.848.821 5.046.549 - - 168.895.370 Land

Bangunan 56.604.072 - - - 56.604.072 Buildings

31 Desember 2023/ 31 Desember 2022/ Mesin dan peralatan 1.081.164.755 47.912.009 (1.228.967) (1.512.290 ) 1.126.335.507 Machineries and equipment

December 31, 2023 December 31, 2022

Kendaraan bermotor 187.040.205 36.501.468 (10.464.238) 5.655.537 218.732.972 Motor vehicles

Perabotan dan Furniture, fixtures and

Total aset 119.666.302 117.473.172 Total assets

peralatan kantor 172.356.850 10.023.668 (2.061.551) (150.151 ) 180.168.816 office equipment

Total liabilitas (14.223.646) (14.346.749) Total liabilities

Total biaya perolehan 1.661.014.703 99.483.694 (13.754.756) 3.993.096 * 1.750.736.737 Total cost

Ekuitas 105.442.656 103.126.423 Equity

Akumulasi penyusutan Accumulated depreciation

Bagian Grup atas ekuitas - 40% 42.177.062 41.250.568 Group’s share in equity - 40% Bangunan 31.024.173 2.296.294 - - 33.320.467 Buildings

Goodwill 6.455.349 6.455.349 Goodwill Mesin dan peralatan 712.075.084 77.975.448 (1.104.738) (1.298.502 ) 787.647.292 Machineries and equipment

Kendaraan bermotor 128.735.998 21.768.492 (4.517.654 ) 3.056.299 149.043.135 Motor vehicles

Nilai tercatat atas investasi Grup 48.632.411 47.705.917 Group’s carrying amount of investment Perabotan dan Furniture, fixtures and

peralatan kantor 152.654.622 12.144.327 (2.058.057) (149.089) 162.591.803 office equipment

Laba tahun berjalan 2.316.234 4.397.183 Profit for the year Total akumulasi Total accumulated

Bagian atas laba 926.494 1.758.873 Share in profit penyusutan 1.024.489.877 114.184.561 (7.680.449) 1.608.708 * 1.132.602.697 depreciation

Nilai tercatat neto 636.524.826 618.134.040 Net carrying amount

Perusahaan asosiasi tersebut memerlukan The associate company requires the Company’s *) Termasuk reklasifikasi biaya perolehan dan akumulasi penyusutan dari aset hak-guna masing-masing sebesar Rp5.655.537 dan Rp3.056.299 dan

persetujuan Perusahaan untuk membagikan consent to distribute its profits. The associate reklasifikasi biaya perolehan dan akumulasi penyusutan ke piutang lain-lain masing-masing sebesar Rp1.662.442 dan Rp1.447.591/ include

reclassifications of cost and accumulated depreciation from right-of-use assets amounting to Rp5,655,537 and Rp3.056.299,

keuntungannya. Perusahaan asosiasi tidak company has no contingent liabilities or capital

respectively and reclassification of cost and accumulated depreciation to other receivables amounting to Rp1,662,442 and Rp1,447,591, respectively.

memiliki liabilitas kontinjensi atau komitmen commitments as of December 31, 2023 and 2022.

modal pada tanggal 31 Desember 2023 dan 2022.

Manajemen berkeyakinan bahwa tidak terdapat Management believes that there were no indicators

indikasi penurunan nilai atas goodwill tersebut di of impairment existed on the abovementioned

atas. goodwill.

54 55