Page 334 - Artwork AR SR FFI (KFC) Revised_2022.V.1.08.05.2023_compressed

P. 334

IKHTISAR KINERJA UTAMA LAPORAN MANAJEMEN PROFIL PERUSAHAAN

PERFORMANCE HIGHLIGHTS MANAGEMENT REPORTS COMPANY PROFILE

The original financial statements included

herein are in the Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Untuk Tahun yang Berakhir pada Tanggal For the Year than Ended

31 Desember 2022 December 31, 2022

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

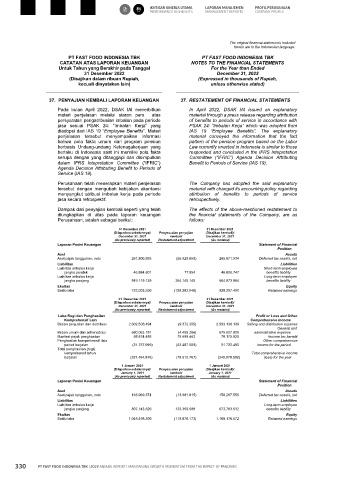

37. PENYAJIAN KEMBALI LAPORAN KEUANGAN 37. RESTATEMENT OF FINANCIAL STATEMENTS

Pada bulan April 2022, DSAK IAI menerbitkan In April 2022, DSAK IAI issued an explanatory

materi penjelasan melalui siaran pers atas material through a press release regarding attribution

persyaratan pengatribusian imbalan pada periode of benefits to periods of service in accordance with

jasa sesuai PSAK 24: “Imbalan Kerja” yang PSAK 24: “Imbalan Kerja” which was adopted from

diadopsi dari IAS 19 “Employee Benefits”. Materi IAS 19 “Employee Benefits”. The explanatory

penjelasan tersebut menyampaikan informasi material conveyed the information that the fact

bahwa pola fakta umum dari program pensiun pattern of the pension program based on the Labor

berbasis Undang-undang Ketenagakerjaan yang Law currently enacted in Indonesia is similar to those

berlaku di Indonesia saat ini memiliki pola fakta responded and concluded in the IFRS Intepretation

serupa dengan yang ditanggapi dan disimpulkan Committee (“IFRIC”) Agenda Decision Attributing

dalam IFRS Intepretation Committee (“IFRIC”) Benefit to Periods of Service (IAS 19).

Agenda Decision Attributing Benefit to Periods of

Service (IAS 19).

Perusahaan telah menerapkan materi penjelasan The Company has adopted the said explanatory

tersebut dengan mengubah kebijakan akuntansi material with changed its accounting policy regarding

menyangkut atribusi imbalan kerja pada periode attribution of benefits to periods of service

jasa secara retrospektif. retrospectively.

Dampak dari penyajian kembali seperti yang telah The effects of the above-mentioned restatement to

diungkapkan di atas pada laporan keuangan the financial statements of the Company, are as

Perusahaan, adalah sebagai berikut: follows:

31 Desember 2021 31 Desember 2021

(Dilaporkan sebelumnya)/ Penyesuaian penyajian (Disajikan kembali)/

December 31, 2021 kembali/ December 31, 2021

(As previously reported) Restatement adjustment (As restated)

Laporan Posisi Keuangan Statement of Financial

Position

Aset Assets

Aset pajak tangguhan, neto 261.800.993 (55.929.059) 205.871.934 Deferred tax assets, net

Liabilitas Liabilities

Liabilitas imbalan kerja Short-term employee

jangka pendek 46.884.601 77.854 46.806.747 benefits liability

Liabilitas imbalan kerja Long-term employee

jangka panjang 919.119.129 254.145.145 664.973.984 benefits liability

Ekuitas Equity

Saldo laba 722.003.550 (198.293.940) 920.297.490 Retained earnings

31 Desember 2021 31 Desember 2021

(Dilaporkan sebelumnya)/ Penyesuaian penyajian (Disajikan kembali)/

December 31, 2021 kembali/ December 31, 2021

(As previously reported) Restatement adjustment (As restated)

Laba Rugi dan Penghasilan Profit or Loss and Other

Komprehensif Lain Comprehensive Income

Beban penjualan dan distribusi 2.602.508.494 (9.372.355) 2.593.136.139 Selling and distribution expense

General and

Beban umum dan administrasi 680.063.191 (4.455.286) 675.607.905 administrative expense

Manfaat pajak penghasilan 88.874.488 18.699.463 70.175.025 Income tax benefit

Penghasilan komprehensif lain Other comprehensive

period berjalan (31.757.099) (83.487.589) 51.730.490 income for the period

Total penghasilan (rugi)

komprehensif tahun Total comprehensive income

berjalan (327.494.849) (78.615.767) (248.879.082) (loss) for the year

1 Januari 2021 1 Januari 2021

(Dilaporkan sebelumnya)/ Penyesuaian penyajian (Disajikan kembali)/

January 1, 2021 kembali/ January 1, 2021

(As previously reported) Restatement adjustment (As restated)

Laporan Posisi Keuangan Statement of Financial

Position

Aset Assets

Aset pajak tangguhan, neto 163.969.374 (13.681.815) 150.287.559 Deferred tax assets, net

Liabilitas Liabilities

Liabilitas imbalan kerja Long-term employee

jangka panjang 807.143.520 133.359.988 673.783.532 benefits liability

Ekuitas Equity

Saldo laba 1.049.498.399 (119.678.173) 1.169.176.572 Retained earnings

97

330 PT FAST FOOD INDONESIA TBK | 2022 ANNUAL REPORT | MAINTAINING GROWTH MOMENTUM FROM THE IMPACT OF PANDEMIC