Page 324 - Artwork AR SR FFI (KFC) Revised_2022.V.1.08.05.2023_compressed

P. 324

IKHTISAR KINERJA UTAMA LAPORAN MANAJEMEN PROFIL PERUSAHAAN

PERFORMANCE HIGHLIGHTS MANAGEMENT REPORTS COMPANY PROFILE

The original financial statements included

herein are in the Indonesian language.

PT FAST FOOD INDONESIA TBK PT FAST FOOD INDONESIA TBK

CATATAN ATAS LAPORAN KEUANGAN NOTES TO THE FINANCIAL STATEMENTS

Untuk Tahun yang Berakhir pada Tanggal For the Year than Ended

31 Desember 2022 December 31, 2022

(Disajikan dalam ribuan Rupiah, (Expressed in thousands of Rupiah,

kecuali dinyatakan lain) unless otherwise stated)

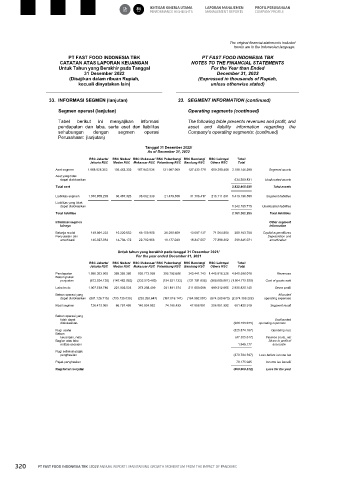

33. INFORMASI SEGMEN (lanjutan) 33. SEGMENT INFORMATION (continued)

Segmen operasi (lanjutan) Operating segments (continued)

Tabel berikut ini menyajikan informasi The following table presents revenues and profit, and

pendapatan dan laba, serta aset dan liabilitas asset and liability information regarding the

sehubungan dengan segmen operasi Company’s operating segments: (continued)

Perusahaan: (lanjutan)

Tanggal 31 Desember 2022/

As of December 31, 2022

RSC Jakarta/ RSC Medan/ RSC Makassar/ RSC Palembang/ RSC Bandung/ RSC Lainnya/ Total/

Jakarta RSC Medan RSC Makassar RSC Palembang RSC Bandung RSC Others RSC Total

Aset segmen 1.988.928.353 102.463.332 187.943.036 121.987.900 127.433.179 659.390.408 3.188.146.208 Segment assets

Aset yang tidak

dapat dialokasikan 634.258.831 Unallocated assets

Total aset 3.822.405.039 Total assets

Liabilitas segmen 1.076.809.299 36.487.326 36.602.339 21.479.308 31.706.417 216.111.891 1.419.196.580 Segment liabilities

Liabilitas yang tidak

dapat dialokasikan 1.342.185.715 Unallocated liabilities

Total liabilitas 2.761.382.295 Total liabilities

Informasi segmen Other segment

lainnya information

Belanja modal 149.891.222 10.220.052 18.159.908 26.250.659 13.097.137 71.564.808 289.183.786 Capital expenditures

Penyusutan dan Depreciation and

amortisasi 145.927.034 14.704.172 22.792.966 19.177.040 18.347.557 77.396.302 298.345.071 amortization

Untuk tahun yang berakhir pada tanggal 31 Desember 2021/

For the year ended December 31, 2021

RSC Jakarta/ RSC Medan/ RSC Makassar/ RSC Palembang/ RSC Bandung/ RSC Lainnya/ Total/

Jakarta RSC Medan RSC Makassar RSC Palembang RSC Bandung RSC Others RSC Total

Pendapatan 1.680.363.908 369.395.386 605.773.959 395.702.696 343.441.743 1.445.918.326 4.840.596.018 Revenues

Beban pokok

penjualan (672.824.128) (147.462.852) (232.570.460) (154.521.122) (131.791.655) (565.605.661) (1.904.775.878) Cost of goods sold

Laba bruto 1.007.539.780 221.932.534 373.203.499 241.181.574 211.650.088 880.312.665 2.935.820.140 Gross profit

Beban operasi yang Allocated

dapat dialokasikan (881.126.715) (155.135.039) (232.268.647) (167.016.141) (164.592.007) (674.260.673) (2.274.399.222) operating expenses

Hasil segmen 126.413.065 66.797.495 140.934.852 74.165.433 47.058.081 206.051.992 661.420.918 Segment result

Beban operasi yang

tidak dapat Unallocated

dialokasikan (986.795.075) operating expenses

Rugi usaha (325.374.157) Operating loss

Beban

keuangan, neto (47.355.617) Finance costs, net

Bagian atas laba Share in profit of

entitas asosiasi 1.945.177 associate

Rugi sebelum pajak

penghasilan (370.784.597) Loss before income tax

Pajak penghasilan 70.175.025 Income tax benefit

Rugi tahun berjalan (300.609.572) Loss for the year

87

320 PT FAST FOOD INDONESIA TBK | 2022 ANNUAL REPORT | MAINTAINING GROWTH MOMENTUM FROM THE IMPACT OF PANDEMIC